Why Is My Cash App Card Disabled? Unlocking the Reasons and Solutions

Discovering your Cash App card is disabled can be a frustrating and unsettling experience. Suddenly, access to your funds is cut off, leaving you wondering what went wrong and how to fix it. This comprehensive guide dives deep into the various reasons your Cash App card might be disabled, providing you with actionable solutions and expert advice to regain control of your finances. We’ll explore common causes, preventative measures, and steps to take if you find yourself locked out of your account. Our goal is to empower you with the knowledge and tools to navigate this situation effectively and ensure a seamless Cash App experience.

Understanding the Cash App Card and Its Functionality

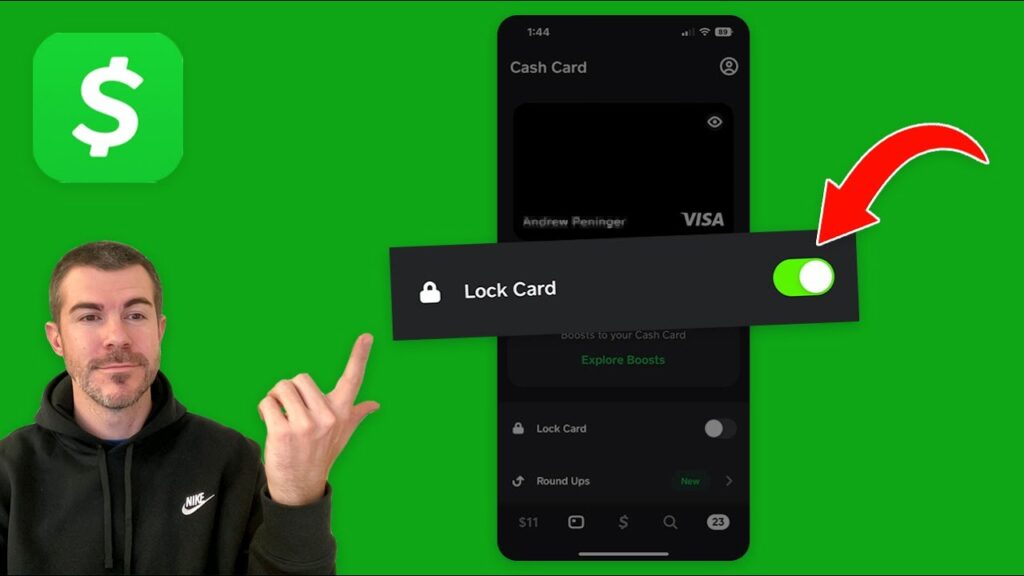

The Cash App card, a Visa debit card linked to your Cash App balance, provides a convenient way to spend your funds both online and in physical stores. It offers the flexibility of a traditional debit card with the added benefits of Cash App’s peer-to-peer payment system. Understanding how the card works is crucial to troubleshooting issues and preventing future disruptions.

Think of the Cash App card as a direct extension of your Cash App account. When you make a purchase, the funds are directly deducted from your Cash App balance. You can also use the card at ATMs to withdraw cash. The card’s versatility makes it a popular choice for users who prefer a cashless payment method.

The Link Between Your Card and Your Account

It’s important to remember that your Cash App card is intrinsically linked to your Cash App account. Any restrictions or issues affecting your account will likely impact your card’s functionality. This means that if your account is flagged for suspicious activity, your card will likely be disabled as a precautionary measure. Similarly, if you violate Cash App’s terms of service, your card could be suspended.

Common Reasons Why Your Cash App Card Might Be Disabled

Several factors can lead to the deactivation of your Cash App card. Understanding these reasons is the first step towards resolving the issue. Here are some of the most common culprits:

- Suspicious Activity: Cash App employs sophisticated algorithms to detect potentially fraudulent transactions. Unusual spending patterns, large or frequent transfers, or transactions from unfamiliar locations can trigger a security alert and lead to card disablement.

- Violation of Terms of Service: Engaging in activities prohibited by Cash App’s terms of service, such as using the app for illegal purposes or attempting to exploit loopholes, can result in immediate card suspension.

- Incorrect Information: Providing inaccurate or outdated personal information during the account setup process can raise red flags and lead to verification issues, ultimately affecting your card’s status.

- Account Security Concerns: If Cash App detects unauthorized access attempts to your account, such as multiple failed login attempts from different IP addresses, your card might be disabled to protect your funds.

- Card Reported Lost or Stolen: If you previously reported your card lost or stolen and subsequently found it, you’ll need to contact Cash App support to reactivate it. Simply finding the card won’t automatically restore its functionality.

- Inactivity: While less common, prolonged inactivity on your Cash App account can sometimes lead to card deactivation as a security measure.

- Technical Glitches: In rare cases, technical issues within the Cash App system can cause temporary card disablement.

Troubleshooting a Disabled Cash App Card: A Step-by-Step Guide

If you find your Cash App card is disabled, don’t panic. Here’s a systematic approach to identify the problem and find a solution:

- Check Your Cash App Account for Notifications: The first step is to open your Cash App and look for any alerts or notifications regarding your account or card status. Cash App often provides a reason for the disablement and instructions on how to resolve the issue.

- Review Your Recent Transaction History: Examine your recent transactions for any unusual or suspicious activity. This can help you identify potential triggers that might have led to the card being disabled.

- Verify Your Personal Information: Ensure that the personal information associated with your Cash App account, such as your name, address, date of birth, and Social Security number (if provided), is accurate and up-to-date.

- Contact Cash App Support: If you’ve exhausted the above steps and still can’t determine the cause of the disablement, contact Cash App support directly. You can reach them through the app or via their website. Be prepared to provide your account information and explain the situation clearly and concisely.

- Consider Filing a Formal Complaint: If you’re unsatisfied with Cash App’s response or believe your card was unfairly disabled, you can consider filing a formal complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office.

Preventative Measures: Keeping Your Cash App Card Active and Secure

Prevention is always better than cure. Here are some proactive steps you can take to minimize the risk of your Cash App card being disabled:

- Monitor Your Account Activity Regularly: Keep a close eye on your Cash App transactions and report any unauthorized or suspicious activity immediately.

- Use Strong Passwords and Enable Two-Factor Authentication: Protect your account with a strong, unique password and enable two-factor authentication for an extra layer of security.

- Avoid Sharing Your Cash App Tag or PIN: Never share your Cash App tag or PIN with anyone, and be cautious about clicking on suspicious links or responding to phishing emails.

- Keep Your App Updated: Regularly update your Cash App to ensure you have the latest security patches and bug fixes.

- Be Mindful of Transaction Amounts and Frequency: Avoid making unusually large or frequent transactions, as these can trigger security alerts.

- Comply with Cash App’s Terms of Service: Familiarize yourself with Cash App’s terms of service and adhere to them strictly.

Cash App Support: Navigating the Assistance Process

When your Cash App card is disabled, contacting support is often the most direct route to resolution. However, navigating the support process can sometimes be challenging. Here’s a breakdown of what to expect and how to make the most of your interaction with Cash App support:

Reaching Out to Support

You can contact Cash App support through several channels:

- In-App Support: The most convenient way to reach support is through the Cash App itself. Navigate to your profile, select “Support,” and then choose the relevant issue.

- Email: You can also email Cash App support, although response times may be slower compared to in-app support.

- Phone: Cash App offers phone support, but it’s often limited and may require navigating automated menus.

Preparing for Your Interaction

Before contacting support, gather all relevant information, including your account details, transaction history, and a clear explanation of the issue. This will help the support agent understand your situation and provide more efficient assistance.

What to Expect

Be prepared to answer questions about your account and recent transactions. The support agent may also ask you to verify your identity. Remain patient and polite throughout the interaction, even if you’re frustrated. Remember, the support agent is there to help you resolve the issue.

Understanding Cash App’s Security Measures

Cash App employs a multi-layered security system to protect its users from fraud and unauthorized access. These measures include:

- Encryption: Cash App uses encryption to protect your financial information during transmission.

- Fraud Detection Algorithms: Sophisticated algorithms monitor transactions for suspicious patterns and flag potentially fraudulent activity.

- Two-Factor Authentication: This adds an extra layer of security by requiring a code from your phone in addition to your password when logging in.

- Account Monitoring: Cash App actively monitors accounts for suspicious activity and may take action to protect users from fraud.

While these security measures are designed to protect users, they can sometimes lead to false positives, resulting in legitimate transactions being flagged and cards being disabled. Understanding how these systems work can help you avoid triggering unnecessary security alerts.

Alternatives to Cash App: Exploring Other Mobile Payment Options

While Cash App is a popular choice for mobile payments, several alternatives offer similar functionality. Exploring these options can provide you with backup solutions in case you encounter issues with your Cash App card.

- Venmo: Similar to Cash App, Venmo allows you to send and receive money with friends and family.

- PayPal: A widely used online payment platform that offers a range of services, including peer-to-peer payments and online shopping.

- Zelle: A bank-backed payment network that allows you to send money directly to other bank accounts.

- Google Pay: A mobile payment platform that allows you to make contactless payments in stores and send money to friends and family.

- Apple Pay: Similar to Google Pay, Apple Pay allows you to make contactless payments and send money to other Apple users.

Having multiple mobile payment options can provide you with greater flexibility and reduce your reliance on a single platform.

Real-World Examples: Scenarios Leading to Card Disablement

To further illustrate the reasons why your Cash App card might be disabled, let’s examine some real-world scenarios:

- Scenario 1: A user attempts to send a large sum of money to an unfamiliar recipient. Cash App flags the transaction as potentially fraudulent and disables the user’s card as a precautionary measure.

- Scenario 2: A user’s account is compromised, and an unauthorized individual attempts to make several purchases using the Cash App card. Cash App detects the suspicious activity and disables the card to prevent further fraud.

- Scenario 3: A user violates Cash App’s terms of service by using the app to facilitate illegal transactions. Cash App suspends the user’s account and disables their card.

- Scenario 4: A user provides inaccurate personal information during the account setup process, leading to verification issues and card disablement.

These examples highlight the importance of understanding Cash App’s security measures and adhering to its terms of service.

Expert Advice: Navigating the Cash App Landscape

Navigating the world of mobile payments can be tricky. Here’s some expert advice to help you make the most of Cash App while minimizing the risk of encountering issues:

- Be Proactive About Security: Take steps to protect your account from unauthorized access, such as using strong passwords and enabling two-factor authentication.

- Stay Informed About Cash App’s Policies: Keep up-to-date with Cash App’s terms of service and security policies.

- Be Cautious About Suspicious Transactions: Avoid engaging in transactions that seem too good to be true or involve unfamiliar recipients.

- Contact Support Promptly: If you encounter any issues with your account or card, contact Cash App support immediately.

By following these tips, you can enjoy the convenience of Cash App while minimizing the risk of encountering problems.

Gaining Back Control of Your Cash App Card

Understanding the intricate workings of Cash App, its security protocols, and the common pitfalls that can lead to a disabled card empowers you to take proactive steps. By monitoring your account activity, adhering to Cash App’s terms of service, and staying vigilant against potential security threats, you can significantly reduce the likelihood of encountering this frustrating issue. When issues arise, remember the troubleshooting steps outlined in this guide, and don’t hesitate to contact Cash App support for assistance. With the right knowledge and approach, you can regain control of your Cash App card and continue enjoying the convenience and flexibility it offers.