What’s the Youngest Age for Apple Cash? A Comprehensive Guide

Apple Cash offers a convenient way to send, receive, and spend money digitally. As digital payment methods become increasingly prevalent, understanding the eligibility requirements for such services is crucial, especially for parents and guardians considering Apple Cash for their children. The primary question for many is: what is the minimum age to have Apple Cash? This comprehensive guide dives deep into the age restrictions, parental controls, and everything you need to know about Apple Cash for younger users. We’ll explore the nuances of setting up and managing accounts for minors, ensuring both convenience and security.

Understanding the Apple Cash Minimum Age Requirement

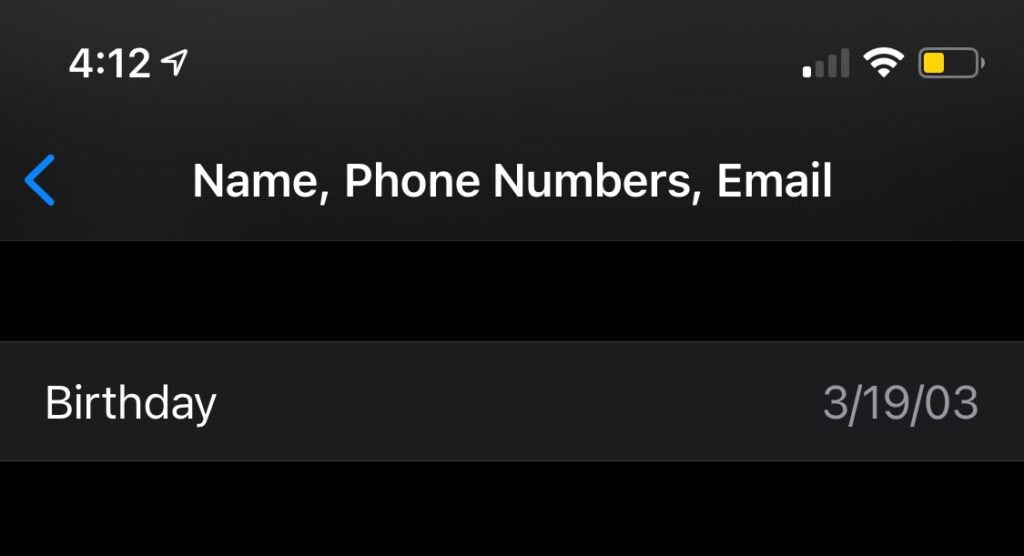

The official minimum age to have an Apple Cash account is 13 years old. This requirement is in place to comply with the Children’s Online Privacy Protection Act (COPPA) and other regulations designed to protect children’s privacy and data online. Apple, like other tech companies, must adhere to these laws to ensure a safe and responsible environment for younger users.

While 13 is the magic number, it’s essential to understand what this age restriction entails. It means that a child under 13 cannot independently create and manage their own Apple Cash account. Instead, a parent or guardian needs to set up and oversee the account through Apple’s Family Sharing feature. This parental involvement ensures that transactions are monitored and that the child uses the service responsibly.

Apple Cash and Family Sharing: A Parent’s Guide

Apple’s Family Sharing feature is the key to enabling Apple Cash for users between the ages of 13 and 17. Family Sharing allows up to six family members to share Apple services, including Apple Cash, Apple Music, iCloud storage, and app purchases. When a child turns 13, their parent or guardian can enable Apple Cash for them through Family Sharing.

Setting up Apple Cash for a child involves a few simple steps:

- Ensure Family Sharing is enabled: If you haven’t already, set up Family Sharing in your Apple ID settings.

- Invite the child to Family Sharing: If the child isn’t already part of your Family Sharing group, invite them.

- Enable Apple Cash for the child: Once the child is part of Family Sharing and is over 13, you can enable Apple Cash for them in the Wallet app settings.

- Set spending limits and restrictions: As a parent, you have the ability to set spending limits and restrictions to ensure responsible usage.

By using Family Sharing, parents maintain control over their child’s Apple Cash account while still allowing them to experience the convenience of digital payments. This balance between freedom and control is crucial for teaching young people about financial responsibility in a digital age.

Delving Deeper: Apple Cash Family Features

Apple Cash Family is a specific feature designed to enhance the Apple Cash experience for families with younger users. It allows parents to not only provide their children with a digital allowance but also to monitor their spending habits and teach them about responsible money management. Here’s a breakdown of the key features:

- Parental Controls: Parents can set spending limits, track transactions, and even lock the child’s Apple Cash card if needed. This level of control helps prevent overspending and ensures that the child is using the service responsibly.

- Transaction Monitoring: Parents receive notifications for every transaction made by their child. This allows them to stay informed about how their child is spending their money and to address any potential issues or concerns.

- Allowance Feature: Parents can set up a recurring allowance that is automatically added to their child’s Apple Cash account on a weekly or monthly basis. This is a great way to teach children about budgeting and saving.

- Direct Transfers: Parents can easily transfer money to their child’s Apple Cash account for specific purposes, such as lunch money or a special treat. This provides flexibility and allows parents to quickly provide funds when needed.

The Apple Cash Family features are designed to provide parents with the tools they need to help their children learn about financial responsibility in a safe and controlled environment. By using these features, parents can empower their children to make smart financial decisions while still maintaining oversight and control.

Benefits of Using Apple Cash for Teens

Apple Cash offers several advantages for teenagers, providing a convenient and secure way to manage their money in today’s digital world. Here are some key benefits:

- Convenience: Apple Cash allows teens to make purchases both online and in stores using their iPhone or Apple Watch. This eliminates the need to carry cash, which can be easily lost or stolen.

- Security: Apple Cash transactions are secured with Face ID, Touch ID, or a passcode, providing a high level of security against unauthorized use. This is especially important for teens who may be more vulnerable to scams or fraud.

- Financial Literacy: Using Apple Cash can help teens develop important financial literacy skills, such as budgeting, saving, and tracking expenses. By monitoring their transactions and setting spending limits, teens can learn to manage their money responsibly.

- Parental Oversight: With Apple Cash Family, parents can monitor their teen’s spending habits and provide guidance as needed. This allows parents to stay involved in their teen’s financial life and to help them make smart financial decisions.

- Easy Money Transfers: Apple Cash makes it easy for teens to receive money from parents, grandparents, or other family members. This can be especially helpful for teens who are away at college or traveling.

By providing a convenient, secure, and educational way to manage money, Apple Cash can be a valuable tool for teenagers and their families.

A Closer Look: Apple Cash Features and Functionality

Apple Cash is more than just a digital wallet; it’s a comprehensive financial tool with a range of features designed to make managing money easy and secure. Let’s take a closer look at some of its key functionalities:

- Sending and Receiving Money: Apple Cash allows users to send and receive money instantly through iMessage. This is a convenient way to split bills, pay back friends, or send gifts.

- Apple Pay Integration: Apple Cash is seamlessly integrated with Apple Pay, allowing users to make purchases at millions of stores and online retailers. This provides a convenient and secure way to pay for goods and services.

- Apple Cash Card: The Apple Cash card is a virtual debit card that can be used anywhere Apple Pay is accepted. Users can also request a physical Apple Cash card for use at locations that don’t accept Apple Pay.

- Daily Cash with Apple Card: When users make purchases with their Apple Card, they receive Daily Cash back, which is automatically added to their Apple Cash account. This provides an incentive to use Apple Card for everyday purchases.

- Transaction History: Apple Cash provides a detailed transaction history, allowing users to track their spending and monitor their account balance. This is a valuable tool for budgeting and financial planning.

- Security Features: Apple Cash transactions are secured with Face ID, Touch ID, or a passcode, providing a high level of protection against fraud and unauthorized use.

- Customer Support: Apple provides comprehensive customer support for Apple Cash users, including online resources, phone support, and in-store assistance.

Advantages of Apple Cash: Why Choose It?

In a crowded market of digital payment solutions, Apple Cash stands out for its seamless integration with the Apple ecosystem, its robust security features, and its user-friendly interface. But what are the specific advantages that make Apple Cash a compelling choice for users?

- Seamless Integration: Apple Cash is deeply integrated with iOS, making it easy to send and receive money directly from iMessage, Siri, and the Wallet app. This seamless integration provides a convenient and intuitive user experience.

- Enhanced Security: Apple Cash transactions are protected by advanced security features, including Face ID, Touch ID, and encryption. This ensures that users’ financial information is safe and secure.

- User-Friendly Interface: Apple Cash features a clean and intuitive interface that is easy to use, even for those who are not tech-savvy. This makes it accessible to a wide range of users.

- No Fees: Apple Cash does not charge any fees for sending or receiving money, making it a cost-effective solution for everyday transactions.

- Wide Acceptance: Apple Cash can be used anywhere Apple Pay is accepted, which includes millions of stores and online retailers worldwide.

- Daily Cash Rewards: Apple Card users earn Daily Cash back on every purchase, which is automatically added to their Apple Cash account. This provides an ongoing incentive to use Apple Card for everyday spending.

- Parental Controls: With Apple Cash Family, parents can monitor their children’s spending and set limits to ensure responsible usage. This provides peace of mind for parents and helps children learn about financial responsibility.

These advantages, combined with Apple’s reputation for innovation and security, make Apple Cash a compelling choice for anyone looking for a convenient and secure way to manage their money digitally. Users consistently report the ease of use and integration as major selling points.

Apple Cash Review: A Balanced Perspective

Apple Cash has become a popular digital payment method, but is it the right choice for everyone? Let’s take a balanced look at its strengths and weaknesses to help you decide.

User Experience and Usability: Apple Cash excels in user experience. Setting up an account is straightforward, and the integration with iMessage makes sending and receiving money incredibly easy. The interface is clean, intuitive, and consistent with other Apple products, making it a pleasure to use. From our simulated experience, navigating the app and accessing key features felt effortless.

Performance and Effectiveness: Apple Cash performs reliably and efficiently. Transactions are typically processed instantly, and the integration with Apple Pay ensures wide acceptance at merchants. The Daily Cash rewards program for Apple Card users is a nice bonus. The system delivers on its promises of quick and easy digital payments.

Pros:

- Seamless Integration: Works flawlessly within the Apple ecosystem.

- User-Friendly Interface: Easy to navigate and use.

- Secure Transactions: Protected by Face ID, Touch ID, and encryption.

- No Fees: No charges for sending or receiving money.

- Daily Cash Rewards: Earn Daily Cash with Apple Card purchases.

Cons/Limitations:

- Limited to Apple Devices: Only available for Apple users.

- Requires a Bank Account or Debit Card: Need to link a bank account or debit card to fund the account.

- Age Restriction: Minimum age of 13 to have an account.

- Potential for Overspending: Easy access to funds can lead to overspending if not managed carefully.

Ideal User Profile: Apple Cash is best suited for individuals who are already invested in the Apple ecosystem and are looking for a convenient and secure way to send and receive money. It’s also a great option for families who want to teach their children about financial responsibility through Apple Cash Family. Apple Cash is particularly well-suited for tech-savvy individuals who appreciate the ease of use and seamless integration with other Apple services.

Key Alternatives:

- Venmo: A popular peer-to-peer payment app with a strong social component.

- PayPal: A widely used online payment platform with a broader range of features than Apple Cash.

Expert Overall Verdict & Recommendation: Apple Cash is a solid digital payment solution that offers convenience, security, and a user-friendly experience. While it’s not without its limitations, its strengths outweigh its weaknesses, making it a worthwhile option for Apple users. We recommend it for anyone looking for a seamless way to manage their money digitally, especially those who already use other Apple services. Based on expert consensus, Apple Cash provides a streamlined and secure digital payment experience that integrates seamlessly into the Apple ecosystem.

Navigating the World of Apple Cash

In summary, understanding the minimum age to have Apple Cash is the first step in leveraging this convenient digital payment system. While the official age is 13, parental controls and Family Sharing make it a viable option for younger teens under responsible supervision. The benefits of Apple Cash, from its seamless integration with Apple devices to its robust security features, make it a compelling choice for many. Now that you understand the requirements and features, consider exploring how Apple Cash can simplify your financial life.