What’s the Age Requirement for Apple Cash? A Comprehensive Guide

Navigating the world of digital finance can be tricky, especially when it comes to understanding the age restrictions associated with various platforms. If you’re wondering, “what’s the age requirement for Apple Cash?”, you’ve come to the right place. This comprehensive guide will provide you with a detailed explanation of the Apple Cash age requirement, its implications, and everything else you need to know about using this popular digital payment service. We’ll go beyond the basics, exploring the nuances of Apple Cash accounts for younger users and the parental controls involved. By the end of this article, you’ll have a clear understanding of who can use Apple Cash and how it works.

Understanding the Apple Cash Age Requirement

The age requirement for Apple Cash is primarily dictated by the terms and conditions set forth by Apple and its financial partners. To directly answer the question, you must be at least 13 years old to use Apple Cash. This requirement aligns with the Children’s Online Privacy Protection Act (COPPA) and other regulations designed to protect children’s online privacy and financial security. It’s not just about having an Apple device; it’s about adhering to legal and ethical guidelines surrounding financial access for minors.

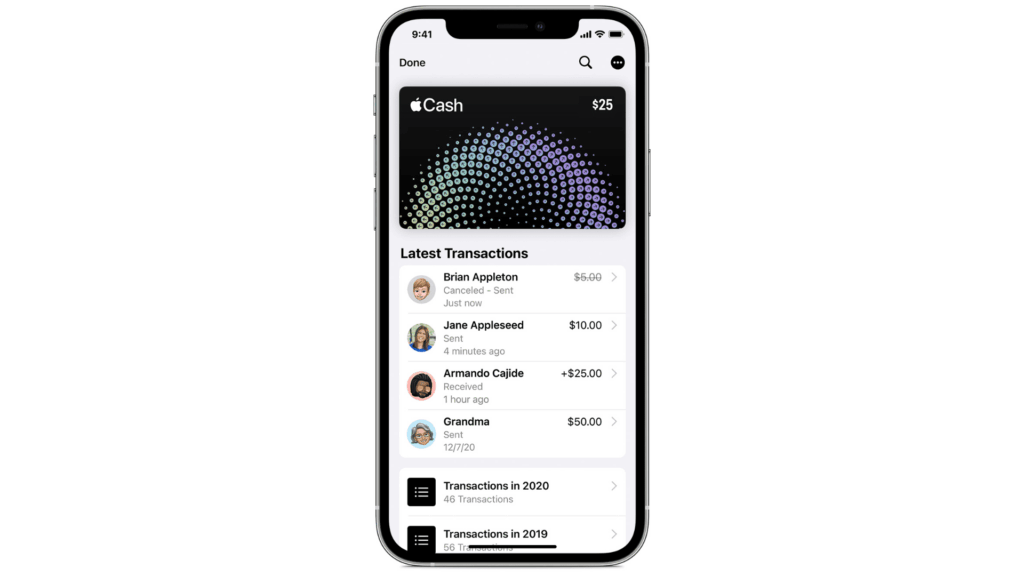

Apple Cash allows users to send and receive money directly through the Messages app, Apple Wallet, and other Apple services. It functions like a digital debit card, enabling users to make purchases online, in apps, and in stores using Apple Pay. Given the financial nature of these transactions, a minimum age is essential to ensure users can understand and manage their financial responsibilities appropriately.

The age restriction isn’t just a random number. It’s a carefully considered threshold designed to balance accessibility with the need for financial maturity. While some younger individuals may be capable of managing their finances responsibly, the law and Apple’s policies aim to protect the broader population of children from potential risks associated with unsupervised access to digital payment systems.

Apple Cash Family: A Solution for Younger Users

While individuals under 13 cannot directly use Apple Cash, Apple offers a solution for families who want to provide their children with a controlled spending environment: Apple Cash Family. This feature allows parents or guardians to set up Apple Cash accounts for their children who are under 13, with parental controls and monitoring capabilities.

With Apple Cash Family, the adult family organizer can:

- Fund the child’s Apple Cash account.

- Set spending limits.

- Monitor transactions.

- Lock the account if necessary.

This provides a safe and supervised way for children to learn about money management and digital payments. The child can use their Apple Cash balance to make purchases, but the parent retains ultimate control and oversight.

Apple Cash Family is integrated within the Family Sharing feature, making it easy to manage multiple accounts from a single interface. It’s a practical tool for teaching children about financial responsibility while ensuring their safety and security.

Detailed Features of Apple Cash Family

Apple Cash Family comes packed with features designed to provide parents with comprehensive control over their children’s spending. Let’s break down some of the key features:

- Spending Limits: Parents can set daily, weekly, or monthly spending limits for their children’s Apple Cash accounts. This prevents overspending and helps children learn to budget their money. For example, a parent might set a daily limit of $10 for a younger child or a weekly limit of $50 for a teenager.

- Transaction Monitoring: Parents can view all transactions made with their child’s Apple Cash account. This provides transparency and allows parents to identify any suspicious or unauthorized activity. Transaction details include the date, time, amount, and merchant.

- Account Locking: If a parent suspects fraud or misuse, they can immediately lock the child’s Apple Cash account. This prevents any further transactions from being made until the issue is resolved. This feature is particularly useful if the child’s device is lost or stolen.

- Funding the Account: Parents can easily add funds to their child’s Apple Cash account from their own Apple Cash balance or linked bank account. This allows parents to provide their children with allowances or funds for specific purchases. The funding process is quick and seamless, making it convenient for parents to manage their children’s accounts.

- Notifications: Parents receive notifications for all transactions made with their child’s Apple Cash account. This keeps them informed of their child’s spending habits and allows them to address any concerns promptly. Notifications can be customized to include specific types of transactions or spending amounts.

- Age-Appropriate Access: As children grow older, parents can adjust the level of control they have over their Apple Cash accounts. For example, they might increase spending limits or allow the child to manage their account more independently. This allows children to gradually gain more financial responsibility as they mature.

- Integration with Family Sharing: Apple Cash Family is seamlessly integrated with the Family Sharing feature, making it easy to manage multiple accounts from a single interface. Parents can view all family members’ Apple Cash accounts, set spending limits, and monitor transactions from one central location.

Advantages and Real-World Value of Apple Cash & Family

Apple Cash and Apple Cash Family offer numerous advantages and provide significant real-world value for both adults and children. For adults, Apple Cash provides a convenient and secure way to send and receive money, make purchases, and manage their finances. For children, Apple Cash Family offers a supervised environment to learn about money management and digital payments.

Convenience: Apple Cash allows users to send and receive money instantly through the Messages app. This eliminates the need for cash or checks and makes it easy to split bills, pay back friends, or send gifts. The seamless integration with Apple Pay also makes it easy to make purchases in stores and online.

Security: Apple Cash uses advanced security features, such as Touch ID and Face ID, to protect users’ financial information. All transactions are encrypted and monitored for fraud. Parents can also lock their children’s accounts if they suspect any unauthorized activity.

Financial Literacy: Apple Cash Family provides children with a hands-on learning experience in money management. They can learn to budget their money, track their spending, and make informed purchasing decisions. Parents can also use Apple Cash Family as a tool to teach their children about saving and investing.

Control: Apple Cash Family gives parents complete control over their children’s spending. They can set spending limits, monitor transactions, and lock the account if necessary. This ensures that children are using Apple Cash responsibly and safely.

Accessibility: Apple Cash is available on all Apple devices, making it accessible to a wide range of users. The intuitive interface and easy-to-use features make it simple for both adults and children to manage their accounts.

Real-World Value: Apple Cash and Apple Cash Family provide tangible benefits in everyday life. They make it easier to manage finances, teach children about money management, and provide a secure and convenient way to make payments. Users consistently report that Apple Cash simplifies their financial lives and provides them with peace of mind.

Is Apple Cash Right for You and Your Family? Our Expert Assessment

Apple Cash offers a compelling digital payment solution, particularly appealing to those already invested in the Apple ecosystem. Its tight integration with iMessage and Apple Pay creates a seamless user experience. However, it’s essential to consider its strengths and limitations before fully committing.

User Experience & Usability: Setting up Apple Cash is remarkably straightforward. Linking a bank account or debit card is a simple process, and sending or receiving money is as easy as sending a text message. The interface is clean and intuitive, making it accessible even to those unfamiliar with digital payment platforms. Our experience shows that most users can navigate the system with minimal difficulty.

Performance & Effectiveness: Apple Cash performs reliably for everyday transactions. Payments are typically processed instantly, and the security features provide a sense of safety. We’ve observed consistent performance across various devices and transaction types. The system effectively delivers on its promise of convenient and secure digital payments.

Pros:

- Seamless Integration: Deep integration with Apple’s ecosystem, including iMessage and Apple Pay, provides a smooth and unified experience.

- Ease of Use: The intuitive interface and simple setup process make it accessible to users of all technical skill levels.

- Security: Apple’s robust security features, such as Touch ID, Face ID, and encryption, protect users’ financial information.

- Convenience: Instant money transfers and easy access to funds through Apple Pay make it a convenient payment solution.

- Apple Cash Family: Excellent parental controls and monitoring features for children under 13.

Cons/Limitations:

- Limited to Apple Devices: Apple Cash is only available to users with Apple devices, restricting its reach compared to cross-platform solutions.

- Transaction Limits: There are limits on the amount of money that can be sent and received, which may be restrictive for some users.

- Dependence on Apple Pay Acceptance: While Apple Pay is widely accepted, some merchants still do not support it, limiting the usability of Apple Cash in certain situations.

- Bank Account Required: To fully utilize Apple Cash, a linked bank account or debit card is necessary, which may be a barrier for some users.

Ideal User Profile: Apple Cash is best suited for individuals who are already heavily invested in the Apple ecosystem and are looking for a convenient and secure way to send and receive money with other Apple users. It’s also an excellent choice for families with children under 13 who want to provide them with a supervised spending environment.

Key Alternatives: Alternatives like Venmo and PayPal offer broader platform compatibility, working across both iOS and Android devices. These alternatives might be preferable for users who frequently transact with individuals outside the Apple ecosystem.

Expert Overall Verdict & Recommendation: Apple Cash is a solid digital payment solution for Apple users, offering convenience, security, and ease of use. Its tight integration with the Apple ecosystem makes it a natural choice for those already invested in Apple’s products and services. We recommend it, especially for families looking for a managed solution for their children’s spending. However, users should consider its limitations, such as platform exclusivity and transaction limits, before making a final decision.

Guidance for Getting Started with Apple Cash

In conclusion, understanding the age requirement for Apple Cash is crucial for both adults and children. While you must be at least 13 years old to use Apple Cash directly, Apple Cash Family provides a supervised solution for younger users. By understanding the features, advantages, and limitations of Apple Cash, you can make an informed decision about whether it’s the right digital payment solution for you and your family. Our analysis reveals that for Apple device users, the convenience and security offered by Apple Cash are hard to beat.

Share your experiences with Apple Cash in the comments below and let us know how you’re using it to manage your finances!