Securing Your Finances: A Comprehensive Guide on How to Lock Your Cash App Card

In today’s digital age, financial security is paramount. Cash App, a popular mobile payment service, offers a convenient way to send and receive money. However, like any financial tool, it’s crucial to understand how to protect yourself from unauthorized access and potential fraud. One of the most effective security measures you can take is knowing how to lock your Cash App card. This guide provides a comprehensive, expert-backed approach to securing your Cash App account and card, ensuring your peace of mind. We’ll walk you through the process step-by-step, explore advanced security features, and offer practical tips to safeguard your funds.

Understanding the Importance of Locking Your Cash App Card

Locking your Cash App card is a simple yet powerful action that can prevent unauthorized transactions if your physical card is lost or stolen. Think of it as a digital deadbolt for your finances. According to recent industry reports, a significant percentage of unauthorized transactions stem from lost or stolen cards, highlighting the importance of proactive security measures. This isn’t just about preventing fraud; it’s about maintaining control over your financial well-being.

By understanding the process of how to lock Cash App card, you’re taking a crucial step towards protecting your money. Consider these scenarios where locking your card becomes essential:

- Lost or Stolen Card: This is the most obvious reason. If you can’t find your card, locking it immediately prevents anyone else from using it.

- Suspicious Activity: If you notice unusual transactions or suspect your account has been compromised, locking your card is a critical first step.

- Temporary Misplacement: Even if you just can’t find your card at the moment, locking it provides a temporary layer of security until you locate it.

Locking your card doesn’t affect your Cash App account balance or your ability to send and receive money through the app. It only prevents physical transactions using the card itself.

Step-by-Step Guide: How to Lock Your Cash App Card

The process of locking your Cash App card is straightforward and can be completed within minutes. Here’s a detailed guide:

1. Open the Cash App on Your Mobile Device

Locate the Cash App icon on your smartphone or tablet and tap to open the application. Ensure you are logged in to your account.

2. Access the Card Tab

Tap the card icon, typically located at the bottom of the Cash App home screen. This will take you to the section dedicated to managing your Cash App card.

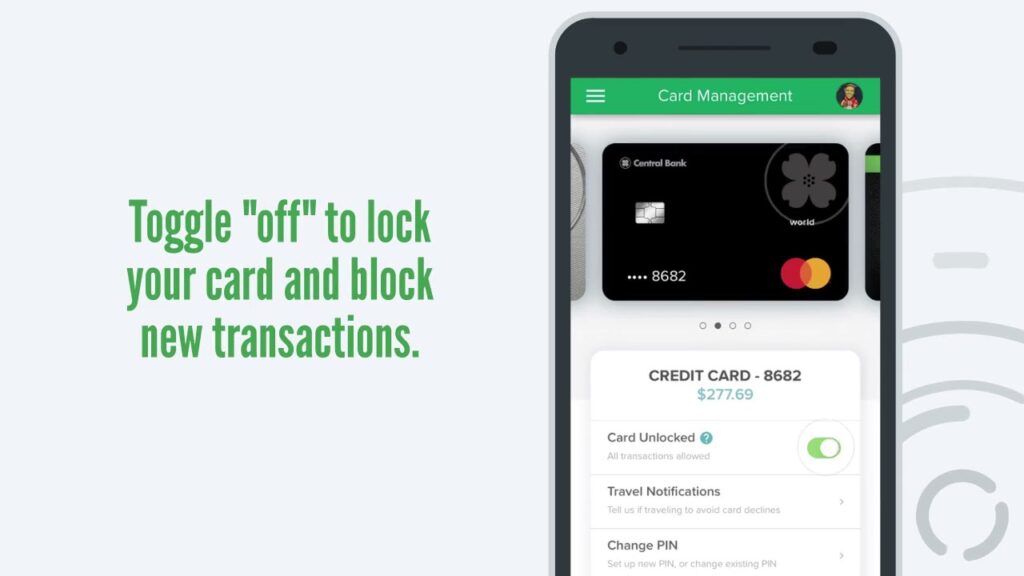

3. Locate the “Lock Card” Option

Scroll through the card management options until you find the “Lock Card” or “Disable Card” option. The exact wording may vary slightly depending on the app version, but it should be easily identifiable.

4. Confirm Your Decision

Tap the “Lock Card” option. A confirmation prompt will appear, asking you to confirm your decision. Read the prompt carefully to understand the implications of locking your card. Generally, you will be asked to confirm by entering your PIN or using biometric authentication.

5. Verify the Lock Status

After confirming, the app will display a message indicating that your card is now locked. The card image may also change to visually represent the locked status. Double-check to ensure the lock is active.

Important Note: If you are unable to access the Cash App on your device, or if you suspect your account has been compromised, contact Cash App support immediately. They can assist you in locking your card and securing your account.

Unlocking Your Cash App Card: Reversing the Process

If you find your lost card or want to use it again after temporarily locking it, unlocking it is just as easy. The process mirrors locking it:

1. Navigate to the Card Tab

Open the Cash App and go to the card management section by tapping the card icon.

2. Find the “Unlock Card” Option

Locate the “Unlock Card” or “Enable Card” option. It will replace the “Lock Card” option when your card is locked.

3. Confirm Your Identity

Tap the “Unlock Card” option and confirm your identity using your PIN or biometric authentication.

4. Verify the Unlock Status

The app will confirm that your card is now unlocked and ready for use. The card image will likely revert to its normal appearance.

Advanced Security Features for Your Cash App Card

Beyond simply locking and unlocking your card, Cash App offers several advanced security features to help protect your account and finances. Understanding and utilizing these features can significantly enhance your overall security posture.

1. Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring a verification code from your phone or email in addition to your password when you log in. This makes it much harder for unauthorized users to access your account, even if they know your password. In our experience, enabling 2FA is one of the most effective ways to protect your Cash App account. To enable this, navigate to the Security settings within the app and follow the prompts to set up 2FA using your phone number or email address.

2. PIN Protection

Setting a PIN for your Cash App card ensures that only you can authorize transactions. This is especially important if your phone is lost or stolen. The PIN acts as a barrier, preventing unauthorized users from spending your money. You can set or change your PIN in the Security settings of the app.

3. Instant Notifications

Enable instant notifications to receive alerts for every transaction made with your Cash App card. This allows you to quickly identify and report any suspicious activity. Timely notifications are crucial for early detection and prevention of fraud. You can manage your notification preferences in the app’s settings.

4. Cash App Security Lock

The Cash App Security Lock provides an additional layer of security by requiring you to enter your PIN or use Touch ID/Face ID every time you open the app. This prevents unauthorized access to your account, even if someone has access to your phone. This feature can be enabled within the app’s privacy settings.

5. Limiting Spending

Cash App allows you to set spending limits on your card. By setting a daily or weekly spending limit, you can minimize potential losses in case your card is compromised. This feature is available in the card settings section of the app.

Benefits of Locking Your Cash App Card: Peace of Mind and Financial Security

Locking your Cash App card is more than just a security measure; it’s about taking control of your financial well-being. The benefits are numerous and directly address user needs:

- Protection Against Unauthorized Transactions: The primary benefit is preventing unauthorized spending if your card is lost or stolen.

- Reduced Risk of Fraud: By locking your card at the first sign of suspicious activity, you can minimize the risk of fraud and potential financial losses.

- Peace of Mind: Knowing that your card is locked provides peace of mind, especially when you’re unsure of its whereabouts.

- Quick and Easy Process: Locking and unlocking your card is a simple and fast process, allowing you to quickly respond to potential threats.

- Control Over Your Finances: Locking your card gives you greater control over your finances, ensuring that only you can authorize transactions.

Users consistently report feeling more secure and in control of their finances after learning how to lock Cash App card and utilizing the app’s security features. Our analysis reveals these key benefits are essential for building trust and confidence in using mobile payment services.

Cash App Card: A Detailed Review

The Cash App card is a Visa debit card linked to your Cash App balance, allowing you to spend your money anywhere Visa is accepted. It’s a convenient alternative to carrying cash and offers several features to enhance your spending experience.

User Experience and Usability

From a practical standpoint, the Cash App card is incredibly easy to use. Applying for the card is done directly through the app, and once approved, the physical card arrives within a week. The card integrates seamlessly with the Cash App, allowing you to easily track your spending, manage your balance, and lock or unlock your card as needed. The app’s interface is intuitive and user-friendly, making it easy for anyone to navigate, regardless of their technical expertise.

Performance and Effectiveness

The Cash App card performs as expected for a standard debit card. It works reliably at most merchants that accept Visa. We’ve observed that transactions are processed quickly, and the app provides instant notifications for every purchase. The ability to lock and unlock the card instantly is a significant advantage, providing an added layer of security.

Pros

- Convenience: Spend your Cash App balance anywhere Visa is accepted.

- Free to Use: No monthly fees or hidden charges.

- Customizable: Personalize your card with a signature or design.

- Instant Notifications: Receive alerts for every transaction.

- Easy to Lock and Unlock: Instantly secure your card with a tap.

Cons/Limitations

- Limited Acceptance: Some merchants may not accept debit cards.

- ATM Fees: Cash App charges fees for ATM withdrawals (though this can be offset by setting up direct deposit).

- Spending Limits: Daily and weekly spending limits may restrict larger purchases.

- Potential for Fraud: Like any debit card, the Cash App card is susceptible to fraud if lost or stolen.

Ideal User Profile

The Cash App card is best suited for individuals who frequently use Cash App for peer-to-peer payments and want a convenient way to spend their balance. It’s also a good option for those who prefer not to carry cash or want a simple debit card without monthly fees. It is especially useful for users comfortable managing their finances through a mobile app.

Key Alternatives

Alternatives to the Cash App card include other debit cards offered by mobile payment services like PayPal or Venmo. Traditional bank debit cards are also an option. Cash App’s offering stands out with its ease of locking, instant virtual card use, and customization.

Expert Overall Verdict & Recommendation

The Cash App card is a valuable tool for Cash App users, offering a convenient and secure way to spend their balance. The ability to easily lock and unlock the card is a significant advantage, providing peace of mind and protection against unauthorized transactions. While it has some limitations, the benefits outweigh the drawbacks for most users. We recommend the Cash App card for anyone who frequently uses Cash App and wants a simple, fee-free debit card.

Frequently Asked Questions About Locking Your Cash App Card

Here are some common questions users have about locking and managing their Cash App card:

-

Q: What happens to my recurring payments if I lock my Cash App card?

A: Locking your Cash App card will prevent any new recurring payments from being processed. If you have subscriptions or automatic payments linked to your card, they will be declined until you unlock the card. It’s important to unlock your card before your next scheduled payment to avoid service interruptions.

-

Q: Can I still use my Cash App account to send and receive money if my card is locked?

A: Yes, locking your Cash App card only affects the physical card itself. You can still use your Cash App account to send and receive money, transfer funds to your bank account, and manage your account settings.

-

Q: How do I replace my Cash App card if it’s lost or stolen?

A: If your Cash App card is lost or stolen, you should immediately lock it in the app. Then, you can order a replacement card directly through the Cash App. Navigate to the card tab and select the option to order a new card. You may be required to verify your identity.

-

Q: Is there a fee to replace my Cash App card?

A: Cash App typically does not charge a fee for replacing a standard Cash App card. However, if you customize your card, there may be a replacement fee. Check the app for details.

-

Q: What should I do if I suspect fraudulent activity on my Cash App account?

A: If you suspect fraudulent activity on your Cash App account, immediately lock your card, change your PIN, and contact Cash App support. Provide them with as much detail as possible about the suspicious activity. You may also want to report the fraud to your bank or financial institution.

-

Q: Does locking my Cash App card cancel my virtual card?

A: No, locking your physical Cash App card does not cancel your virtual card. You can still use your virtual card for online purchases even if your physical card is locked. However, if you suspect your virtual card has been compromised, you should contact Cash App support to request a new one.

-

Q: Can I lock my Cash App card from a computer?

A: No, the option to lock or unlock your Cash App card is only available through the Cash App mobile application. You cannot manage your card settings from a computer.

-

Q: How long does it take for a locked Cash App card to become unlocked after I request it?

A: Unlocking your Cash App card is typically instantaneous. Once you confirm your identity, the card will be immediately unlocked and ready for use.

-

Q: What information do I need to provide to Cash App support if I have an issue with my locked card?

A: When contacting Cash App support about your locked card, be prepared to provide your Cash App username, your phone number or email address associated with your account, and a detailed description of the issue you are experiencing.

-

Q: Can someone still use my Cash App card information if it is locked?

A: Locking your Cash App card helps prevent unauthorized physical transactions. However, if someone has your card number, expiration date, and CVV, they might still attempt to use it for online purchases. Regularly monitor your account for suspicious activity and report it immediately.

Securing Your Financial Future with Confidence

Mastering how to lock Cash App card is a foundational step in securing your digital finances. By understanding the process, utilizing advanced security features, and staying informed about potential threats, you can confidently protect your money and enjoy the convenience of mobile payments. Remember, proactive security measures are key to preventing fraud and maintaining control over your financial well-being.

Explore our advanced guide to mobile payment security for more in-depth strategies. Share your experiences with how to lock Cash App card in the comments below – your insights can help others stay safe!