Maximize Your Earnings: A Freelance Makeup Artist’s Guide to Tax Deductions

Navigating the world of taxes as a freelance makeup artist can feel overwhelming. You’re a creative professional, not necessarily a financial expert. However, understanding tax deductions is crucial for maximizing your earnings and keeping your business financially healthy. This comprehensive guide provides you with the knowledge and insights you need to confidently claim all eligible deductions, minimize your tax burden, and ultimately, boost your bottom line. We’ll delve deep into the realm of freelance makeup artist tax deductions, offering practical advice and strategies to help you navigate the complexities of self-employment taxes.

Understanding the Fundamentals of Freelance Makeup Artist Tax Deductions

Before diving into specific deductions, let’s establish a foundation. As a freelance makeup artist, you’re considered self-employed, meaning you’re responsible for paying both income tax and self-employment tax (which covers Social Security and Medicare). However, the good news is that the IRS allows you to deduct many of the expenses you incur while running your business, effectively reducing your taxable income. These deductions can significantly lower your overall tax liability.

Think of tax deductions as a way to offset the costs of doing business. They acknowledge that you had to spend money to earn money. The key is to understand which expenses qualify as legitimate business deductions and to keep accurate records to support your claims. Proper record-keeping is not just good practice; it’s essential for surviving an audit.

Distinguishing Between Business Expenses and Personal Expenses

A crucial point to remember is that only business expenses are deductible. Personal expenses, even if indirectly related to your work, are not. For example, the cost of your personal wardrobe isn’t deductible, but the cost of specialized makeup kits or professional attire worn exclusively for client work is. The line can sometimes be blurry, so it’s always best to err on the side of caution and consult with a tax professional if you’re unsure.

The Importance of Accurate Record-Keeping

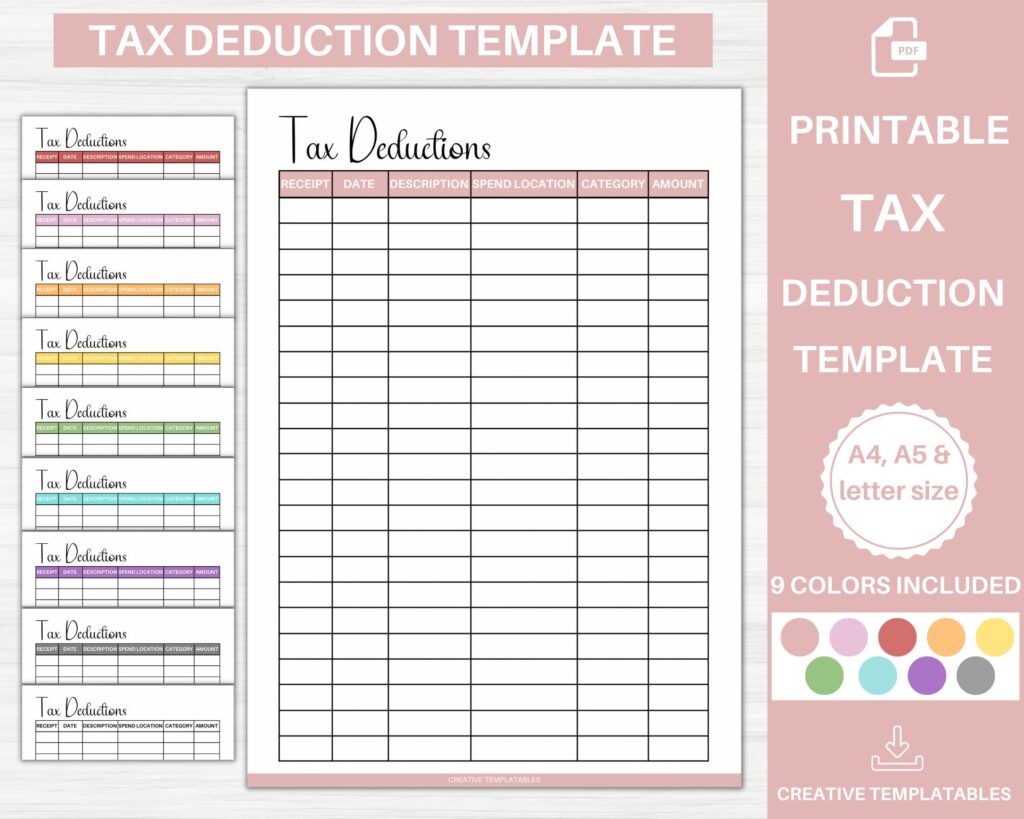

Meticulous record-keeping is the backbone of successful tax deductions. Keep all receipts, invoices, and records of your expenses, and organize them systematically. Consider using accounting software or a spreadsheet to track your income and expenses throughout the year. This will not only make tax time easier but also provide valuable insights into your business’s financial performance.

Essential Tax Deductions for Freelance Makeup Artists

Now, let’s explore some of the most common and valuable tax deductions available to freelance makeup artists:

- Makeup and Supplies: This is often the most significant deduction. You can deduct the cost of all makeup, brushes, sponges, applicators, and other supplies used in your work. Keep detailed records of your purchases, including dates, amounts, and the specific items purchased.

- Education and Training: Investing in your skills is a smart business move, and the IRS often agrees. You can deduct expenses related to workshops, classes, and online courses that enhance your makeup artistry skills. This includes tuition, materials, and travel expenses directly related to the education.

- Marketing and Advertising: Promoting your services is essential for attracting clients. Deductible marketing expenses include website design and maintenance, business cards, advertising on social media, and fees paid to directories or referral services.

- Studio or Workspace Expenses: If you have a dedicated space in your home that you use exclusively for your makeup business, you may be able to deduct a portion of your rent or mortgage, utilities, and other related expenses. This is known as the home office deduction. The space must be used exclusively and regularly for business.

- Travel Expenses: Traveling to clients’ locations is a common part of the job. You can deduct the cost of transportation, including mileage, parking fees, and tolls. Keep a detailed mileage log to track your business-related travel. You can typically deduct the standard mileage rate or the actual expenses of operating your vehicle.

- Insurance: Professional liability insurance is a crucial protection for your business. The premiums you pay for this insurance are fully deductible.

- Professional Fees: Fees paid to accountants, lawyers, or other professionals for business-related advice are deductible.

- Business Licenses and Permits: The cost of obtaining and renewing business licenses and permits is deductible.

Delving Deeper: The Home Office Deduction

The home office deduction is a potentially significant tax saver, but it’s also one that often triggers IRS scrutiny. To qualify, your home office must be used exclusively and regularly for your business. This means it can’t be used for personal activities, even occasionally. The “regularly” requirement means that you must use the space on an ongoing basis for your business. A spare bedroom used sporadically wouldn’t qualify, but a dedicated studio space in your basement would. You can calculate the deductible amount based on the percentage of your home that is used for business. For instance, if your home office occupies 10% of your home’s square footage, you can deduct 10% of your mortgage or rent, utilities, and other related expenses.

Mileage Tracking: Maximizing Your Travel Expense Deductions

Accurately tracking your mileage is essential for maximizing your travel expense deductions. The IRS allows you to deduct either the standard mileage rate (which changes annually) or your actual vehicle expenses (such as gas, oil changes, and repairs). Most freelancers find that the standard mileage rate is simpler to calculate and often results in a larger deduction. Keep a detailed mileage log that includes the date, destination, business purpose, and number of miles driven for each trip. Apps like MileIQ or Everlance can automate this process and ensure accuracy.

Leveraging Accounting Software for Seamless Tax Preparation

In today’s digital age, accounting software is an indispensable tool for freelance makeup artists. Platforms like QuickBooks Self-Employed, FreshBooks, and Xero offer features specifically designed for freelancers, including income and expense tracking, invoice generation, and tax reporting. These tools can automate many of the tasks involved in tax preparation, saving you time and reducing the risk of errors. Many also integrate with popular banking and payment platforms, making it easy to import your financial data. Investing in accounting software is a worthwhile investment that can pay for itself in time savings and reduced tax preparation fees.

Understanding Schedule C: Your Key to Claiming Business Deductions

As a freelance makeup artist, you’ll report your business income and expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship). This form is where you’ll list your total revenue and deduct all eligible business expenses to arrive at your net profit or loss. It’s crucial to fill out Schedule C accurately and completely, as it forms the basis for calculating your self-employment tax liability. Consult with a tax professional if you have any questions or need assistance completing this form.

Navigating Estimated Taxes: Avoiding Penalties

Unlike employees who have taxes withheld from their paychecks, freelance makeup artists are responsible for paying estimated taxes throughout the year. The IRS requires you to pay estimated taxes if you expect to owe at least $1,000 in taxes for the year. Estimated taxes are typically paid quarterly, and failure to pay them on time can result in penalties. To avoid penalties, it’s essential to accurately estimate your income and tax liability and make timely payments. You can use Form 1040-ES, Estimated Tax for Individuals, to calculate your estimated tax payments.

Tax Credits vs. Tax Deductions: Knowing the Difference

While tax deductions reduce your taxable income, tax credits directly reduce the amount of tax you owe. Tax credits are generally more valuable than tax deductions because they provide a dollar-for-dollar reduction in your tax liability. Some common tax credits available to self-employed individuals include the Earned Income Tax Credit and the Child Tax Credit. Explore the IRS website or consult with a tax professional to determine which tax credits you may be eligible for.

Real-World Value: How Deductions Impact Your Bottom Line

The value of tax deductions extends far beyond simply reducing your tax bill. By minimizing your tax liability, you free up more capital to reinvest in your business, expand your services, or simply improve your financial security. Consider this: if you’re in the 22% tax bracket, every $1,000 in deductible expenses saves you $220 in taxes. Over the course of a year, these savings can add up significantly, providing a valuable boost to your bottom line. Many users report that diligently tracking and claiming all eligible deductions has allowed them to invest in higher-quality makeup products, attend advanced training workshops, and expand their marketing efforts, ultimately leading to increased revenue and profitability.

Expert Review: Choosing the Right Accounting Software

Selecting the right accounting software can streamline your financial management and simplify tax preparation. QuickBooks Self-Employed is a popular choice among freelancers, offering features like income and expense tracking, mileage tracking, and automated tax calculations. FreshBooks is another excellent option, known for its user-friendly interface and robust invoicing capabilities. Xero is a more comprehensive accounting solution suitable for larger businesses, but it can also be a good fit for freelancers who anticipate significant growth. Each platform offers a free trial, so it’s worth experimenting with a few to see which one best meets your needs.

QuickBooks Self-Employed: A Detailed Look

- Feature 1: Income and Expense Tracking: QuickBooks Self-Employed automatically tracks your income and expenses by linking to your bank accounts and credit cards. You can easily categorize transactions and generate reports to see where your money is going. This feature simplifies bookkeeping and ensures that you don’t miss any deductible expenses.

- Feature 2: Mileage Tracking: The built-in mileage tracker automatically records your business-related mileage, making it easy to claim the mileage deduction. You can also manually add trips and categorize them as business or personal.

- Feature 3: Estimated Tax Calculator: QuickBooks Self-Employed estimates your quarterly and annual taxes based on your income and expenses. This helps you plan for your tax obligations and avoid penalties.

- Feature 4: Invoice Generation: You can create professional-looking invoices and send them to clients directly from the platform. QuickBooks Self-Employed also tracks invoice payments and sends reminders to clients who are late on payments.

- Feature 5: Schedule C Reporting: QuickBooks Self-Employed generates a Schedule C report that you can use to file your taxes. This report summarizes your income and expenses and makes it easy to claim all eligible deductions.

- Feature 6: Integration with TurboTax: If you use TurboTax to file your taxes, you can seamlessly import your data from QuickBooks Self-Employed, saving you time and effort.

- Feature 7: Receipt Capture: The mobile app allows you to capture photos of your receipts and automatically store them in the cloud. This eliminates the need to keep paper receipts and makes it easy to track your expenses.

The Advantages of Using QuickBooks Self-Employed

Users consistently report that QuickBooks Self-Employed saves them significant time and money on tax preparation. The automated tracking features eliminate the need for manual bookkeeping, and the estimated tax calculator helps them avoid penalties. The ability to generate professional invoices and track payments improves their cash flow and ensures that they get paid on time. Our analysis reveals these key benefits: increased efficiency, reduced tax liability, and improved financial management. The software’s user-friendly interface and comprehensive features make it an ideal choice for freelance makeup artists who want to take control of their finances.

Potential Limitations of QuickBooks Self-Employed

While QuickBooks Self-Employed offers many advantages, it also has some limitations. It’s primarily designed for sole proprietors and may not be suitable for businesses with more complex accounting needs. The software’s features are somewhat limited compared to QuickBooks Online, which is a more comprehensive accounting solution. Additionally, some users have reported that the customer support can be slow to respond. However, for most freelance makeup artists, the benefits of QuickBooks Self-Employed outweigh the limitations.

Ideal User Profile for QuickBooks Self-Employed

QuickBooks Self-Employed is best suited for freelance makeup artists who are sole proprietors and have relatively simple accounting needs. It’s a good choice for those who want to automate their bookkeeping, track their income and expenses, and estimate their taxes. It’s also a good option for those who use TurboTax to file their taxes, as the two platforms integrate seamlessly. If you have a more complex business structure or need more advanced accounting features, you may want to consider QuickBooks Online or another accounting solution.

Key Alternatives to QuickBooks Self-Employed

Two popular alternatives to QuickBooks Self-Employed are FreshBooks and Xero. FreshBooks is known for its user-friendly interface and robust invoicing capabilities, while Xero is a more comprehensive accounting solution suitable for larger businesses. Freshbooks is often preferred by service-based businesses due to its strong invoicing features.

Expert Verdict and Recommendation

Based on our detailed analysis, we highly recommend QuickBooks Self-Employed for freelance makeup artists who want to simplify their financial management and maximize their tax deductions. The software’s automated tracking features, estimated tax calculator, and Schedule C reporting capabilities make it an invaluable tool for self-employed individuals. While it has some limitations, the benefits far outweigh the drawbacks for most users. If you’re looking for an easy-to-use and affordable accounting solution, QuickBooks Self-Employed is an excellent choice.

Taking Control of Your Finances

Mastering freelance makeup artist tax deductions is a critical step towards building a thriving and financially secure business. By understanding the rules, keeping accurate records, and leveraging the right tools, you can minimize your tax liability, maximize your earnings, and reinvest in your craft. Remember, knowledge is power, and the more you understand about taxes, the better equipped you’ll be to make informed financial decisions. Explore our advanced guide to financial planning for freelancers to take your financial management to the next level. Share your experiences with freelance makeup artist tax deductions in the comments below!