FFL Cost Breakdown: What You Need to Know Before Applying

So, you’re thinking about getting your Federal Firearms License (FFL)? You’re not alone. Many entrepreneurs and gun enthusiasts consider this path, but a common question always arises: how much does it cost to get your ffl? The answer, unfortunately, isn’t a simple dollar figure. It’s a multifaceted equation involving initial fees, ongoing expenses, and even potential hidden costs. This comprehensive guide will break down all the financial aspects of obtaining and maintaining an FFL, providing you with a clear understanding of the investment required. We’ll go beyond the surface-level fees, diving into the nuances of compliance, security, and operational costs, ensuring you’re fully prepared for the financial commitment involved. By the end of this article, you’ll have a solid grasp of the true cost of an FFL, enabling you to make an informed decision about your future in the firearms industry.

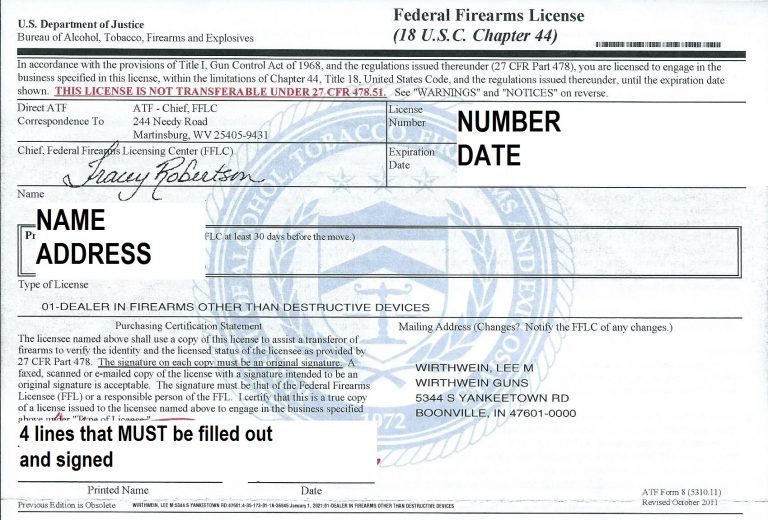

Understanding the Initial FFL Application Fees

The first hurdle in obtaining your FFL is the application fee itself. This fee is paid directly to the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) and varies depending on the type of license you’re applying for. Understanding these different license types and their associated fees is crucial for accurate budgeting.

FFL Types and Associated Costs

The ATF offers several different types of FFLs, each catering to specific business activities. Here’s a breakdown of the most common types and their corresponding application fees (as of late 2024; always confirm with the ATF for the most up-to-date information):

- Type 01: Dealer in Firearms Other Than Destructive Devices: This is the most common type of FFL, allowing you to deal in standard firearms (rifles, shotguns, and handguns). The application fee is typically around $150 for a three-year license.

- Type 02: Pawnbroker in Firearms Other Than Destructive Devices: This license is for pawnbrokers who deal in firearms. The application fee is similar to the Type 01 FFL.

- Type 03: Collector of Curios and Relics: This license allows you to collect firearms that are considered curios or relics. The application fee is significantly lower, often around $30 for three years. Note: This license does *not* allow you to engage in the business of dealing firearms.

- Type 07: Manufacturer of Firearms Other Than Destructive Devices: This license is for those who manufacture firearms. The application fee is generally higher than a Type 01, typically around $150.

- Type 08: Importer of Firearms Other Than Destructive Devices: This license allows you to import firearms. The application fee is similar to the Type 07.

- Type 09: Dealer in Destructive Devices: This license allows you to deal in destructive devices (e.g., grenades, mortars). This requires additional scrutiny and has a higher application fee.

- Type 10: Manufacturer of Destructive Devices: This license is for manufacturing destructive devices.

- Type 11: Importer of Destructive Devices: This license is for importing destructive devices.

It’s important to note that these are just the *application* fees. The ATF also conducts background checks and inspections, which are included in these initial costs. If your application is denied, you will not receive a refund of the application fee.

The Cost of Renewal

Your FFL is not a lifetime license. It needs to be renewed periodically, typically every three years. The renewal fee is generally the same as the initial application fee for the specific license type. However, failing to renew your license on time can result in penalties and even the revocation of your FFL, so it’s crucial to stay on top of the renewal process.

Beyond the Application: Startup and Operational Costs

While the application fee is a fixed cost, the startup and operational expenses associated with running an FFL business can vary widely depending on the scale and nature of your operation. These costs are often significantly higher than the initial application fee and require careful planning.

Securing Your Premises: Security Systems and Insurance

The ATF requires FFL holders to maintain secure premises to prevent theft and unauthorized access to firearms. This often necessitates investing in security systems, such as:

- Alarm Systems: A professionally installed and monitored alarm system is highly recommended. Costs can range from $500 to several thousand dollars, depending on the complexity of the system and the size of your premises. Monthly monitoring fees can add another $20-$100 per month.

- Security Cameras: Surveillance cameras, both indoor and outdoor, are essential for deterring theft and providing evidence in case of a break-in. A good camera system can cost anywhere from $200 to $2000 or more.

- Secure Storage: You’ll need secure storage for your firearms, such as gun safes or locked display cases. The cost of these can range from a few hundred dollars to several thousand, depending on the size and security level.

- Reinforced Doors and Windows: Depending on the location and perceived risk, you may need to reinforce doors and windows to prevent forced entry.

In addition to physical security measures, you’ll also need to obtain adequate insurance coverage. This should include:

- General Liability Insurance: This protects you from liability claims arising from accidents or injuries on your premises.

- Firearms Liability Insurance: This covers you in case a firearm sold by your business is used in a crime.

- Property Insurance: This covers damage to your building and inventory from fire, theft, or other covered perils.

Insurance costs can vary widely depending on your location, the size of your business, and the amount of coverage you need. Expect to pay several hundred to several thousand dollars per year for adequate insurance coverage.

Compliance Costs: ATF Regulations and Record Keeping

Maintaining compliance with ATF regulations is crucial for keeping your FFL in good standing. This involves meticulous record keeping, background checks, and adherence to all applicable laws and regulations. Failure to comply can result in fines, penalties, and even the revocation of your license.

- Acquisition and Disposition (A&D) Record Book: You are required to maintain a detailed record of all firearms you acquire and dispose of. This can be done manually or electronically using ATF-approved software.

- Background Checks: You must conduct background checks on all firearm purchasers through the National Instant Criminal Background Check System (NICS). There may be fees associated with these checks, depending on your state.

- Legal Counsel: It’s highly recommended to consult with an attorney who specializes in firearms law to ensure you are in compliance with all applicable regulations. Legal fees can vary depending on the complexity of your situation.

- Training: Consider attending industry training to stay up-to-date on ATF regulations and best practices.

Electronic A&D software can range from a one-time purchase of a few hundred dollars to subscription-based services costing several hundred dollars per year. The cost of legal counsel and training will depend on your specific needs and the rates charged by the professionals you hire.

Operational Expenses: Rent, Utilities, and Marketing

In addition to security and compliance costs, you’ll also need to factor in the standard operational expenses of running a business, such as:

- Rent or Mortgage: The cost of your premises will depend on its location, size, and condition.

- Utilities: Electricity, water, gas, and internet access are all essential utilities.

- Marketing and Advertising: You’ll need to promote your business to attract customers. This can include online advertising, print ads, and participation in gun shows.

- Inventory: The cost of acquiring firearms to sell will depend on the types of firearms you plan to carry and the volume of your sales.

- Point of Sale (POS) System: Managing inventory and sales efficiently often requires a POS system.

These costs can vary significantly depending on your location and business model. It’s essential to create a detailed budget that accounts for all of these expenses.

Hidden Costs and Unexpected Expenses

Beyond the obvious costs, there are often hidden or unexpected expenses that can catch new FFL holders off guard. Being aware of these potential pitfalls can help you avoid financial surprises.

ATF Inspections and Potential Penalties

The ATF conducts periodic inspections of FFL holders to ensure compliance with regulations. While these inspections are typically routine, they can uncover violations that result in fines, penalties, or even the suspension or revocation of your license.

It’s crucial to be prepared for these inspections by maintaining accurate records, adhering to all regulations, and seeking legal counsel if necessary. The cost of resolving compliance issues can be significant, so it’s best to avoid them in the first place.

Market Fluctuations and Inventory Management

The firearms market can be volatile, with prices and demand fluctuating due to political events, economic conditions, and other factors. This can impact your inventory management and profitability.

It’s important to stay informed about market trends and adjust your inventory accordingly. You may also need to invest in storage solutions to protect your inventory from damage or theft.

Legal Challenges and Lawsuits

As a firearms dealer, you may face legal challenges or lawsuits related to the sale of firearms. This can be costly to defend, even if you are ultimately found not liable.

Adequate insurance coverage is essential to protect you from these types of claims. You should also consult with an attorney to understand your legal obligations and minimize your risk of liability.

The FFL Cost Calculator: Estimating Your Investment

To help you estimate the total cost of getting your FFL, let’s create a sample FFL cost calculator for a Type 01 FFL in a hypothetical location:

Initial Costs:

- FFL Application Fee: $150

- Security System Installation: $1,500

- Gun Safe: $800

- Initial Inventory: $5,000

- Legal Consultation: $500

- Total Initial Costs: $7,950

Ongoing Costs (Annual):

- Rent: $12,000

- Utilities: $2,400

- Insurance: $1,200

- Alarm Monitoring: $300

- Marketing: $1,000

- A&D Software Subscription: $300

- Total Ongoing Costs: $17,200

Renewal Costs (Every 3 Years):

- FFL Renewal Fee: $150

Total Estimated Cost (First 3 Years): $7,950 (Initial) + ($17,200 x 3) (Ongoing) + $150 (Renewal) = $59,700

This is just a rough estimate, and your actual costs may vary. However, it provides a good starting point for planning your budget. Remember to factor in potential hidden costs and unexpected expenses.

Making the Investment: Is an FFL Right for You?

Obtaining and maintaining an FFL involves a significant financial investment. It’s essential to carefully consider your financial situation, business goals, and risk tolerance before making the commitment. If you’re passionate about firearms, willing to invest the necessary time and resources, and committed to complying with all applicable regulations, then an FFL can be a rewarding and profitable venture. However, if you’re not prepared for the financial challenges and regulatory burdens, it may not be the right choice for you.

Based on expert consensus, the true cost of an FFL extends beyond the initial fees. It encompasses security measures, compliance adherence, operational overhead, and potential unexpected expenses. Thorough planning, diligent record-keeping, and a commitment to legal and ethical practices are paramount for success. Considering these factors carefully will pave the way for a responsible and sustainable FFL business.