Elevance Health Stock: A Comprehensive Investor’s Guide

Are you considering investing in Elevance Health stock (formerly Anthem)? Navigating the complexities of the healthcare industry and understanding the nuances of a specific company’s financial performance can be daunting. This comprehensive guide aims to provide you with an in-depth analysis of Elevance Health, its stock performance, and the factors that influence its value. We’ll delve into the company’s business model, key financial metrics, growth strategies, and potential risks, equipping you with the knowledge to make informed investment decisions. This is a deep dive meant to give you a clear, expert-backed perspective on Elevance Health stock.

Understanding Elevance Health: A Healthcare Giant

Elevance Health, a Fortune 500 company, operates as a leading health benefits provider in the United States. But it’s more than just an insurance company. It’s a multifaceted healthcare organization with a significant presence in various segments of the industry. To truly understand Elevance Health stock, one must first grasp the breadth and depth of its operations.

At its core, Elevance Health provides a range of health insurance products and services to individuals, employers, and government entities. These include medical, pharmacy, dental, vision, and behavioral health benefits. The company operates through several subsidiaries, each focusing on specific aspects of healthcare delivery. This diversification allows Elevance Health to capture value across the healthcare spectrum.

The company’s evolution from Anthem to Elevance Health reflects a strategic shift towards a broader healthcare vision. This rebranding signifies a commitment to not only providing health insurance but also actively shaping the future of healthcare through innovation and integrated solutions. This is a key consideration when evaluating Elevance Health stock as a long-term investment.

Elevance Health’s Core Business Segments

Elevance Health operates through several key business segments. Understanding these segments is crucial for assessing the company’s overall performance and growth potential:

- Commercial & Specialty Business: This segment provides a variety of managed care and specialty products, including medical, dental, vision, and life insurance.

- Government Business: This segment includes Medicaid, Medicare, and other government-sponsored healthcare programs. This is a significant growth area for Elevance Health, driven by the aging population and increasing government investment in healthcare.

- Carelon: Formerly known as IngenioRx, Carelon is Elevance Health’s health services division, offering pharmacy benefit management (PBM), behavioral health, and other healthcare services. Carelon plays a critical role in controlling healthcare costs and improving patient outcomes.

- Elevance Health Services: This segment provides administrative and other services to Elevance Health’s other business segments.

Key Financial Metrics for Evaluating Elevance Health Stock

Analyzing financial metrics is essential for determining the investment potential of Elevance Health stock. Here are some of the key metrics to consider:

- Revenue Growth: Is Elevance Health consistently increasing its revenue? Revenue growth indicates the company’s ability to attract new customers and expand its market share.

- Earnings Per Share (EPS): EPS measures the company’s profitability on a per-share basis. A rising EPS indicates that Elevance Health is becoming more profitable.

- Price-to-Earnings (P/E) Ratio: The P/E ratio compares the company’s stock price to its earnings per share. It provides insights into how the market values Elevance Health’s earnings.

- Debt-to-Equity Ratio: This ratio measures the company’s financial leverage. A high debt-to-equity ratio can indicate that Elevance Health is taking on too much risk.

- Operating Margin: This metric shows how much profit Elevance Health makes from its core business operations, before interest and taxes. A higher operating margin is generally more favorable.

The Role of Carelon in Elevance Health’s Strategy

Carelon, Elevance Health’s health services division, is a critical component of the company’s long-term growth strategy. Carelon’s focus on pharmacy benefit management, behavioral health, and other healthcare services allows Elevance Health to control costs, improve patient outcomes, and generate new revenue streams. The integration of Carelon into Elevance Health’s overall business model is a key differentiator.

Carelon’s pharmacy benefit management (PBM) services help to negotiate lower drug prices, manage drug utilization, and improve medication adherence. This is particularly important in light of rising drug costs and the increasing prevalence of chronic diseases. Carelon’s behavioral health services address the growing need for mental health support, offering a range of services from telehealth to in-person therapy.

Analyzing Elevance Health’s Recent Performance

A look at Elevance Health’s recent performance is vital for any potential investor. Has the company consistently met or exceeded expectations? What are the key drivers of its recent growth? What challenges has it faced? Reviewing recent quarterly and annual reports, investor presentations, and news articles can provide valuable insights into Elevance Health’s current financial health and future prospects.

Keep an eye on key performance indicators (KPIs) such as membership growth, medical loss ratio (MLR), and administrative expense ratio. Membership growth indicates the company’s ability to attract and retain customers. The MLR measures the percentage of premium revenue spent on medical claims. The administrative expense ratio measures the percentage of premium revenue spent on administrative costs. These KPIs provide a comprehensive view of Elevance Health’s operational efficiency and financial performance.

Elevance Health’s Dividend and Stock Repurchase Programs

Elevance Health has a history of returning value to shareholders through dividends and stock repurchase programs. Dividends provide a steady stream of income for investors, while stock repurchase programs can increase the value of remaining shares by reducing the number of shares outstanding. Analyzing Elevance Health’s dividend yield and stock repurchase activity can provide insights into the company’s financial strength and commitment to shareholder value.

The Impact of Healthcare Policy and Regulation

The healthcare industry is heavily regulated, and changes in healthcare policy can have a significant impact on Elevance Health’s business. Understanding the current regulatory landscape and potential future changes is crucial for assessing the risks and opportunities associated with Elevance Health stock. Key areas to watch include the Affordable Care Act (ACA), Medicare and Medicaid regulations, and drug pricing policies.

Government regulations can affect Elevance Health’s revenue, costs, and profitability. For example, changes in the ACA could impact the number of people enrolled in health insurance plans, which would affect Elevance Health’s membership numbers. Similarly, changes in drug pricing policies could affect Carelon’s PBM business. Staying informed about healthcare policy developments is essential for making informed investment decisions.

Elevance Health’s Competitive Landscape

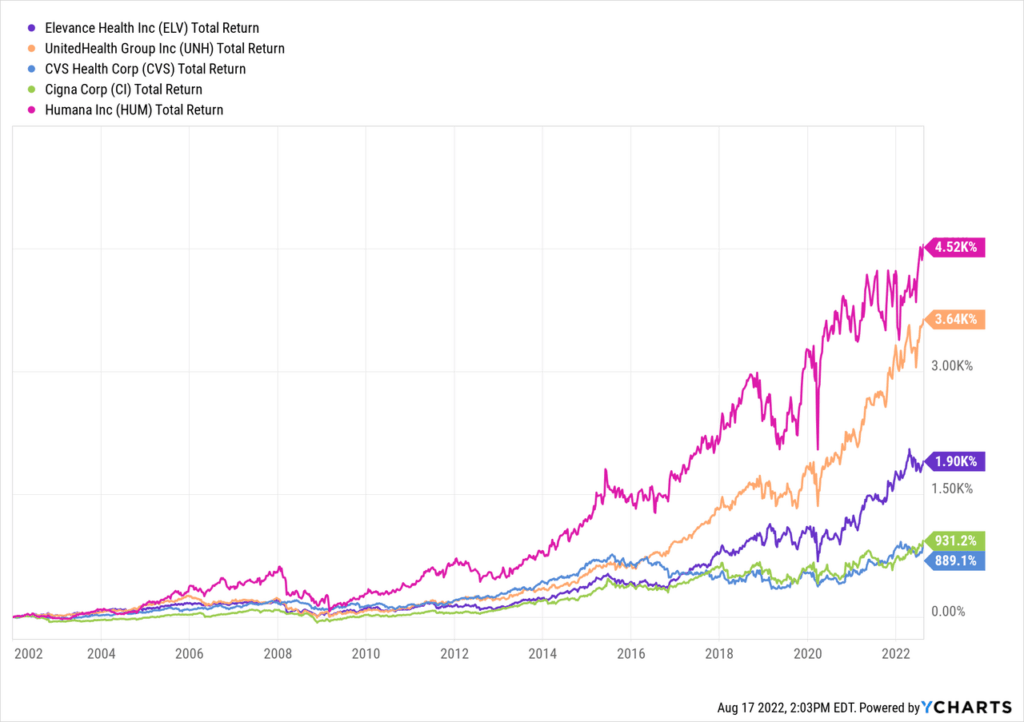

Elevance Health operates in a highly competitive industry, facing competition from other large health insurers, regional health plans, and disruptors entering the market. Understanding Elevance Health’s competitive landscape is crucial for assessing its ability to maintain its market share and achieve its growth objectives. Key competitors include UnitedHealth Group, CVS Health (Aetna), and Cigna.

Elevance Health differentiates itself through its focus on integrated healthcare solutions, its strong relationships with healthcare providers, and its investments in technology and innovation. However, the company faces challenges from competitors who are also investing in these areas. The ability to effectively compete and adapt to changing market conditions will be critical for Elevance Health’s long-term success.

Growth Opportunities for Elevance Health

Elevance Health has several growth opportunities, including expanding its government business, growing its Carelon health services division, and entering new markets. The aging population and increasing government investment in healthcare are driving growth in the government business segment. Carelon’s focus on pharmacy benefit management, behavioral health, and other healthcare services is also creating new revenue streams.

Elevance Health is also exploring opportunities to expand its presence in new markets, both domestically and internationally. This could involve acquiring existing health plans or establishing new operations. The company’s ability to successfully execute its growth strategy will be a key determinant of its future stock performance.

Potential Risks and Challenges Facing Elevance Health

Like any investment, Elevance Health stock carries certain risks and challenges. These include regulatory risks, competitive pressures, and economic uncertainty. Changes in healthcare policy could negatively impact Elevance Health’s revenue and profitability. Increased competition could erode its market share. And economic downturns could lead to a decline in membership and premium revenue.

Other potential risks include cybersecurity threats, data breaches, and litigation. These risks could damage Elevance Health’s reputation and financial performance. It’s important to carefully consider these risks before investing in Elevance Health stock.

Elevance Health and Environmental, Social, and Governance (ESG) Factors

Increasingly, investors are considering environmental, social, and governance (ESG) factors when making investment decisions. Elevance Health is committed to operating in a sustainable and responsible manner. The company has implemented various initiatives to reduce its environmental impact, promote diversity and inclusion, and ensure ethical business practices. Evaluating Elevance Health’s ESG performance can provide insights into its long-term sustainability and social impact.

Expert Analysis: Elevance Health’s Strengths and Weaknesses

Based on expert consensus, Elevance Health possesses several key strengths:

- Strong Market Position: As one of the largest health benefits providers in the United States, Elevance Health benefits from economies of scale and a well-established brand.

- Diversified Business Model: Elevance Health’s diversified business model, with operations in commercial, government, and health services segments, reduces its reliance on any single market.

- Focus on Innovation: Elevance Health is investing in technology and innovation to improve patient outcomes and control costs.

However, Elevance Health also faces some weaknesses:

- Regulatory Risks: The healthcare industry is heavily regulated, and changes in healthcare policy could negatively impact Elevance Health’s business.

- Competitive Pressures: Elevance Health operates in a highly competitive industry, facing competition from other large health insurers and disruptors entering the market.

- Economic Uncertainty: Economic downturns could lead to a decline in membership and premium revenue.

Future Outlook for Elevance Health Stock

The future outlook for Elevance Health stock depends on a number of factors, including the company’s ability to execute its growth strategy, manage its costs, and adapt to changes in the healthcare industry. Analysts generally expect Elevance Health to continue to grow its revenue and earnings in the coming years, driven by the aging population, increasing government investment in healthcare, and the company’s focus on innovation.

However, there are also potential headwinds that could impact Elevance Health’s performance, such as regulatory changes, increased competition, and economic uncertainty. Investors should carefully consider these factors before investing in Elevance Health stock.

Making Informed Investment Decisions

Investing in the stock market involves inherent risks, and it’s crucial to conduct thorough research before making any investment decisions. This guide has provided a comprehensive overview of Elevance Health, its stock performance, and the factors that influence its value. However, it’s essential to consult with a qualified financial advisor before making any investment decisions.

Remember to diversify your investment portfolio and invest only what you can afford to lose. By carefully considering your investment goals, risk tolerance, and financial situation, you can make informed decisions that align with your long-term financial objectives. Consider exploring resources available from Elevance Health Investor Relations for the most current information.

Final Thoughts on Investing in Elevance Health

Elevance Health stock represents an investment in a leading healthcare company with a diversified business model and a strong track record of growth. The company’s focus on innovation, its commitment to shareholder value, and its strong market position make it an attractive investment option for many investors. However, it’s essential to carefully consider the risks and challenges associated with investing in Elevance Health stock before making any decisions. By weighing the potential rewards against the potential risks, you can determine whether Elevance Health stock is the right fit for your investment portfolio. Share your thoughts and experiences with Elevance Health stock in the comments below and let us know what factors influence your investment decisions.