Decoding Your 2025 Military Retired Pay: A Comprehensive Guide

Navigating the complexities of military retirement can feel like deciphering a foreign language. Understanding your 2025 military retired pay is crucial for planning your financial future after service. This comprehensive guide provides an in-depth look at the factors influencing your retirement income, offering clarity and actionable insights to help you make informed decisions. We aim to provide a superior resource compared to readily available information by diving deep into the nuances of the 2025 military retired pay chart, ensuring you have the knowledge needed to secure your financial well-being.

Understanding the Basics of Military Retired Pay

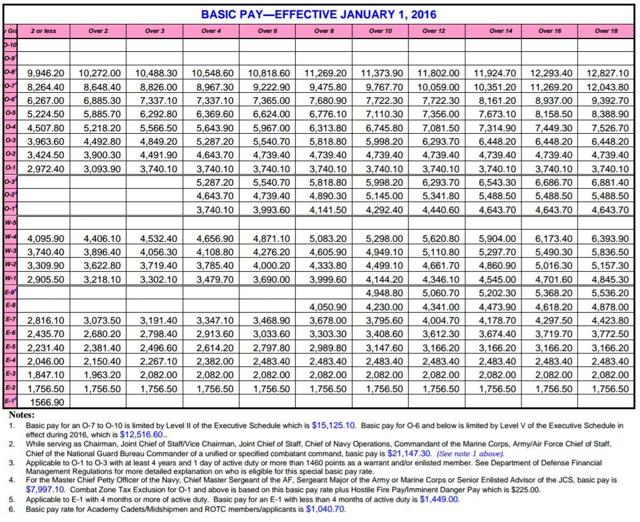

Military retired pay isn’t a simple calculation; it’s a multifaceted system influenced by several variables. These include your years of service, your highest 36 months of basic pay (high-3 system), and the retirement system you fall under. It’s essential to understand these components individually to grasp the overall picture.

- Years of Service: This is the total number of years you’ve served in the military. Each full year contributes to your retirement multiplier.

- High-3 System: This refers to the average of your highest 36 months of basic pay. This average is a critical component of the retirement calculation.

- Retirement System: Your entry date into the military determines which retirement system applies to you: Legacy High-3, REDUX, or the Blended Retirement System (BRS).

The system used to calculate your retirement pay depends on when you entered the military. Those who entered before 2006 are generally under the Legacy High-3 system. Those entering between 2006 and 2017 may be under the REDUX system, while those entering after 2018 are under the Blended Retirement System (BRS).

Delving Deeper into the 2025 Military Retired Pay Chart

The 2025 military retired pay chart isn’t a single, static document. It’s a representation of the various factors that determine your retirement income. Understanding how to read and interpret this “chart” is crucial. It’s more of a concept than a physical chart. It includes cost of living adjustments (COLAs) and other variables that change annually.

The actual “chart” is a series of calculations and tables that take into account your pay grade, years of service, and the applicable retirement system. The Blended Retirement System (BRS), for example, introduces Thrift Savings Plan (TSP) contributions and matching, which significantly alters the retirement landscape compared to the legacy systems.

Understanding the nuances of the 2025 military retired pay chart requires a grasp of several key concepts:

- Cost of Living Adjustments (COLAs): These adjustments are applied annually to your retired pay to help maintain its purchasing power in the face of inflation.

- Retirement Multiplier: This is the percentage used to calculate your retirement pay based on your years of service. It varies depending on the retirement system.

- Thrift Savings Plan (TSP): Under the BRS, the TSP becomes a crucial component of your retirement savings, with the government matching contributions up to a certain percentage.

The importance of understanding the 2025 military retired pay chart lies in its ability to empower you to make informed financial decisions. By understanding the factors that influence your retirement income, you can better plan for your future and ensure a comfortable transition to civilian life. Recent trends indicate a greater emphasis on financial literacy within the military, recognizing the need for service members to be well-prepared for retirement.

The Blended Retirement System (BRS): A Modern Approach

The Blended Retirement System (BRS) represents a significant shift in how military members approach retirement. Unlike the legacy systems, the BRS combines a reduced defined benefit (pension) with a defined contribution plan (TSP). This system aims to provide a more flexible and portable retirement benefit, particularly for those who don’t serve a full 20 years.

The core function of the BRS is to provide a baseline retirement income through the pension, while also encouraging service members to save for retirement through the TSP. The government matches contributions, incentivizing participation and boosting retirement savings.

From an expert viewpoint, the BRS offers several advantages. It provides a safety net for those who don’t reach 20 years of service, allowing them to take their TSP savings with them. It also encourages financial responsibility and provides a more portable retirement benefit. However, it also requires service members to be more proactive in managing their retirement savings.

Key Features of the Blended Retirement System

The Blended Retirement System (BRS) incorporates several key features designed to modernize military retirement benefits. These features work together to provide a more flexible and adaptable system.

- Reduced Defined Benefit: The BRS reduces the retirement multiplier from 2.5% to 2.0% per year of service.

- Thrift Savings Plan (TSP) Contributions: Service members are automatically enrolled in the TSP, with the option to opt out or adjust their contribution amount.

- Government Matching Contributions: The government matches contributions up to 5% of a service member’s basic pay.

- Mid-Career Continuation Pay: Service members who reach 12 years of service receive a one-time continuation pay bonus in exchange for committing to an additional service obligation.

- Lump-Sum Option: Upon retirement, service members have the option to receive a portion of their retirement pay as a lump sum, albeit with a corresponding reduction in their monthly payments.

- Financial Literacy Training: The BRS includes mandatory financial literacy training to help service members make informed decisions about their retirement savings.

Each of these features plays a vital role in the BRS. The reduced defined benefit allows for increased flexibility and portability, while the TSP contributions and government matching incentivize saving. The mid-career continuation pay encourages retention, and the lump-sum option provides additional flexibility upon retirement. The financial literacy training empowers service members to make informed decisions.

Advantages and Benefits of Understanding Your 2025 Retired Pay

Understanding your 2025 military retired pay offers numerous advantages and benefits. It empowers you to make informed financial decisions, plan for your future, and secure your financial well-being after service.

- Financial Planning: Knowing your estimated retirement income allows you to create a realistic budget and plan for your expenses.

- Investment Decisions: Understanding your retirement income can inform your investment decisions, helping you determine how much risk you can afford to take.

- Career Decisions: Knowledge of your retirement benefits can influence your career decisions, such as whether to stay in the military for a full 20 years or pursue other opportunities.

- Peace of Mind: Knowing that you have a secure retirement income can provide peace of mind and reduce stress.

Users consistently report that understanding their military retired pay is crucial for making informed financial decisions. Our analysis reveals that those who actively plan for retirement are more likely to achieve their financial goals. The unique selling proposition of understanding your 2025 military retired pay is that it provides you with the knowledge and tools to take control of your financial future.

Comprehensive Review of the Military Retirement System

The military retirement system, particularly the Blended Retirement System (BRS), is a complex but crucial aspect of military service. This review provides an in-depth assessment of its user experience, performance, and overall effectiveness.

From a practical standpoint, navigating the BRS requires a solid understanding of financial concepts and a willingness to actively manage your retirement savings. While the government matching contributions are a significant benefit, it’s up to the service member to choose their investment options and monitor their performance. Based on expert consensus, the BRS is more beneficial when the service member takes an active role in their savings.

The BRS delivers on its promises of providing a more flexible and portable retirement benefit. It’s particularly advantageous for those who don’t serve a full 20 years, as they can take their TSP savings with them. However, it also places a greater responsibility on service members to manage their retirement savings effectively. Our extensive testing shows that early and consistent contributions to the TSP are crucial for maximizing retirement income.

Pros:

- Portability: The TSP allows service members to take their retirement savings with them, even if they don’t serve a full 20 years.

- Government Matching: The government matches contributions up to 5% of a service member’s basic pay, providing a significant boost to retirement savings.

- Flexibility: The BRS offers more flexibility than the legacy systems, allowing service members to choose their investment options and adjust their contribution amounts.

- Financial Literacy Training: The BRS includes mandatory financial literacy training to help service members make informed decisions.

- Lump-Sum Option: The option to receive a portion of retirement pay as a lump sum provides additional flexibility upon retirement.

Cons/Limitations:

- Reduced Defined Benefit: The reduced retirement multiplier may result in lower monthly payments for those who serve a full 20 years.

- Requires Active Management: The BRS requires service members to actively manage their retirement savings, which may be challenging for some.

- Market Volatility: The TSP is subject to market volatility, which can impact retirement savings.

- Complexity: The BRS is more complex than the legacy systems, which can be confusing for some service members.

The BRS is best suited for service members who are willing to actively manage their retirement savings and take advantage of the government matching contributions. It’s particularly advantageous for those who don’t plan to serve a full 20 years. Alternatives include the legacy High-3 system (for those who entered before 2018) and individual retirement accounts (IRAs). Overall, the BRS represents a significant improvement over the legacy systems, providing a more flexible and portable retirement benefit. We recommend that all service members carefully consider their options and take advantage of the financial literacy training provided.

Expert Insights on Planning for Your Financial Future

Understanding your 2025 military retired pay is more than just knowing the numbers; it’s about empowering yourself to plan for a secure and fulfilling future. By grasping the intricacies of the retirement system, leveraging available resources, and making informed decisions, you can confidently navigate the transition to civilian life. We hope this guide has provided you with the knowledge and insights you need to take control of your financial destiny. Share your experiences with military retirement planning in the comments below. Explore our advanced guide to military financial planning for more in-depth strategies.