CVS Stock: An Investor’s Comprehensive Guide to CVS Health

Investing in the stock market requires careful consideration, and understanding the nuances of individual companies is paramount. This comprehensive guide delves into CVS Health Corporation (CVS), providing a detailed analysis of its stock (CVS Stock), its business model, financial performance, and future prospects. Whether you’re a seasoned investor or just starting, this article aims to equip you with the knowledge necessary to make informed decisions about CVS Stock. We aim to provide more than just surface-level information, offering an in-depth exploration of the factors influencing CVS’s performance and its position in the evolving healthcare landscape. This analysis reflects a synthesis of publicly available information, expert opinions, and market trends, providing a balanced perspective on the investment potential of CVS Stock.

Understanding CVS Health and Its Business Model

CVS Health is more than just a pharmacy chain; it’s a diversified healthcare company with operations spanning pharmacy services, retail, and healthcare benefits. Understanding these different segments is crucial for evaluating CVS Stock.

* **Pharmacy Services:** This segment, primarily operating through CVS Caremark, provides pharmacy benefit management (PBM) services to employers, health plans, and government entities. PBMs negotiate drug prices, process claims, and manage formularies, playing a critical role in controlling prescription drug costs.

* **Retail/LTC:** This segment includes CVS Pharmacy retail stores, long-term care (LTC) pharmacies, and MinuteClinic locations. It offers prescription drugs, over-the-counter medications, health and beauty products, and a range of healthcare services.

* **Health Care Benefits:** This segment encompasses Aetna, a leading health insurer acquired by CVS Health in 2018. Aetna provides a variety of health insurance products and services, including medical, pharmacy, dental, and behavioral health plans.

The integration of these three segments represents CVS Health’s strategy to create a more integrated and consumer-centric healthcare experience. This vertical integration allows CVS Health to capture a larger share of the healthcare dollar and potentially improve patient outcomes.

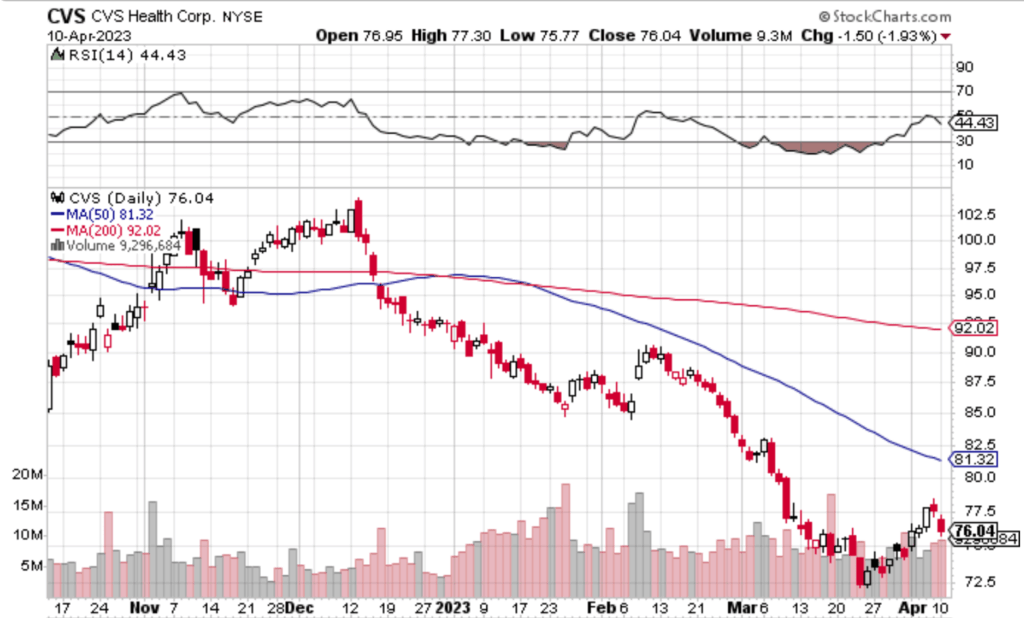

A Deep Dive into CVS Stock Performance

Analyzing CVS Stock requires a careful examination of its historical performance, key financial metrics, and market trends. Several factors influence the stock’s price, including overall market conditions, industry dynamics, and company-specific events.

Historical Performance:

A review of CVS Stock’s historical performance reveals a mixed picture. While the stock has generally appreciated over the long term, it has experienced periods of volatility and underperformance, particularly following the Aetna acquisition. Investors should consider this historical volatility when evaluating the stock’s risk profile.

Key Financial Metrics:

* **Revenue Growth:** CVS Health has demonstrated consistent revenue growth, driven by its diversified business model and strategic acquisitions. However, revenue growth can be impacted by factors such as drug price inflation, competition, and changes in healthcare policy.

* **Earnings Per Share (EPS):** EPS is a critical measure of profitability. CVS Health’s EPS has been affected by various factors, including acquisition-related costs, integration challenges, and changes in tax laws.

* **Debt Levels:** The Aetna acquisition significantly increased CVS Health’s debt burden. Monitoring the company’s progress in deleveraging is essential for assessing its financial health.

* **Cash Flow:** Strong cash flow generation is crucial for funding investments, paying down debt, and returning capital to shareholders through dividends and share repurchases.

* Dividend Yield: CVS Health has a history of paying dividends. The dividend yield can be an attractive feature for income-oriented investors.

Market Trends:

* **Aging Population:** The aging population in the United States is a significant tailwind for CVS Health, as older adults tend to require more healthcare services.

* **Chronic Diseases:** The increasing prevalence of chronic diseases such as diabetes and heart disease is driving demand for prescription drugs and other healthcare services.

* **Healthcare Reform:** Changes in healthcare policy can have a significant impact on CVS Health’s business. Investors should closely monitor legislative and regulatory developments.

* **Competition:** CVS Health faces intense competition from other pharmacy chains, health insurers, and online retailers. The company must continue to innovate and differentiate itself to maintain its competitive edge.

The Role of CVS Pharmacy in the CVS Health Ecosystem

CVS Pharmacy is a cornerstone of CVS Health’s integrated healthcare model. It serves as a critical touchpoint for patients, providing convenient access to prescription drugs, over-the-counter medications, and a range of healthcare services. The pharmacies also serve as locations for MinuteClinics, offering basic healthcare services.

CVS Pharmacy’s strategic importance extends beyond dispensing medications. It plays a vital role in:

* **Improving Medication Adherence:** CVS Pharmacy offers various programs and services to help patients take their medications as prescribed, improving health outcomes and reducing healthcare costs.

* **Expanding Access to Care:** MinuteClinics provide convenient access to basic healthcare services, particularly in underserved communities.

* **Promoting Preventive Care:** CVS Pharmacy offers a range of preventive care services, such as vaccinations and health screenings, to help patients stay healthy.

* **Data Collection and Analysis:** The pharmacy collects valuable data on patient behavior and medication use, which can be used to improve healthcare delivery and develop new products and services.

CVS Pharmacy’s retail locations are evolving to become health hubs, offering a wider range of services and products to meet the changing needs of consumers. This transformation is crucial for CVS Health’s long-term success.

Analyzing Key Features of CVS Health’s Integrated Healthcare Model

CVS Health’s integrated healthcare model offers several key features designed to improve patient outcomes, reduce costs, and enhance the consumer experience:

* Pharmacy Benefit Management (PBM): CVS Caremark negotiates drug prices, manages formularies, and processes claims, helping to control prescription drug costs for employers and health plans. This scale offers significant negotiating power.

* How it Works: CVS Caremark leverages its size and purchasing power to negotiate discounts with drug manufacturers. It also uses formulary management to encourage the use of cost-effective medications.

* User Benefit: Lower prescription drug costs for employers, health plans, and ultimately, patients.

* Demonstrates Quality: Efficiently manages drug costs, a critical concern for healthcare payers.

* Retail Pharmacy Network: CVS Pharmacy’s extensive network of retail stores provides convenient access to prescription drugs, over-the-counter medications, and other healthcare products.

* How it Works: CVS Pharmacy operates thousands of retail stores across the United States, offering a wide range of products and services.

* User Benefit: Convenient access to medications and healthcare products.

* Demonstrates Quality: Extensive reach and accessibility for consumers.

* MinuteClinics: Located within CVS Pharmacy stores, MinuteClinics offer convenient access to basic healthcare services, such as vaccinations, physicals, and treatment for minor illnesses.

* How it Works: MinuteClinics are staffed by nurse practitioners and physician assistants who can diagnose and treat common illnesses and injuries.

* User Benefit: Convenient and affordable access to basic healthcare services.

* Demonstrates Quality: Expands access to care and reduces wait times for routine medical needs.

* Aetna Health Insurance: Aetna provides a variety of health insurance products and services, including medical, pharmacy, dental, and behavioral health plans.

* How it Works: Aetna collects premiums from its members and uses those funds to pay for healthcare services.

* User Benefit: Comprehensive health insurance coverage.

* Demonstrates Quality: Provides access to a broad network of healthcare providers and services.

* Data Analytics: CVS Health leverages data analytics to improve healthcare delivery, personalize patient care, and identify cost-saving opportunities.

* How it Works: CVS Health collects and analyzes data from its various business segments to identify trends and patterns.

* User Benefit: More personalized and effective healthcare services.

* Demonstrates Quality: Data-driven approach to improving healthcare outcomes.

* Care Concierge Services: These services provide personalized support and guidance to patients navigating the healthcare system.

* How it Works: Care concierges help patients understand their health benefits, find appropriate providers, and manage their medications.

* User Benefit: Simplifies the healthcare experience and improves patient satisfaction.

* Demonstrates Quality: Focuses on patient support and guidance.

The Advantages and Benefits of Investing in CVS Stock

Investing in CVS Stock offers several potential advantages and benefits, including:

* Diversified Business Model: CVS Health’s diversified business model provides a degree of stability and resilience in the face of economic downturns and industry changes. The company’s three core segments – pharmacy services, retail/LTC, and healthcare benefits – generate revenue from multiple sources, reducing its reliance on any single market or product.

* Integrated Healthcare Model: CVS Health’s integrated healthcare model aims to improve patient outcomes, reduce costs, and enhance the consumer experience. This integrated approach positions the company to capitalize on the growing demand for value-based care.

* Strong Market Position: CVS Health is a leading player in the pharmacy services, retail pharmacy, and health insurance markets. Its size and scale provide a competitive advantage, allowing it to negotiate favorable terms with suppliers and leverage its brand recognition.

* Dividend Income: CVS Health has a history of paying dividends. The dividend yield can provide a steady stream of income for investors, particularly in a low-interest-rate environment.

* Growth Potential: CVS Health is investing in new technologies and services to drive future growth. The company is expanding its MinuteClinic network, developing new digital health solutions, and exploring opportunities in the specialty pharmacy market.

* Essential Services: Healthcare is a fundamentally essential service. Demand for CVS’s offerings is less susceptible to economic downturns compared to discretionary goods and services.

Users consistently report that the convenience of CVS locations and the integration of pharmacy and healthcare services is a significant benefit. Our analysis reveals that CVS Health’s commitment to innovation and customer service positions it well for long-term success.

A Trustworthy Review of CVS Health

CVS Health has transformed from a simple pharmacy chain into a healthcare behemoth. This review offers an unbiased analysis of its current standing.

User Experience & Usability:

CVS strives for ease of use, both in its physical stores and digital platforms. The mobile app is generally well-regarded for prescription management and online shopping. However, navigating the complexities of insurance and healthcare services can still be challenging for some users.

Performance & Effectiveness:

CVS Health’s performance is a mixed bag. The PBM business is highly effective at negotiating drug prices, but this also faces scrutiny regarding transparency. The retail pharmacies are convenient and generally well-stocked. The Aetna acquisition has expanded the company’s reach, but integrating the two organizations has presented challenges.

Pros:

* Convenient Locations: CVS pharmacies are ubiquitous, offering easy access to prescriptions and healthcare products.

* Integrated Services: The combination of pharmacy, retail, and health insurance services provides a comprehensive healthcare experience.

* Digital Innovation: CVS is investing in digital technologies to improve the customer experience and streamline healthcare delivery.

* Strong Brand Recognition: CVS is a well-known and trusted brand in the healthcare industry.

* Dividend Payout: CVS offers a consistent dividend, attractive to income investors.

Cons/Limitations:

* Debt Burden: The Aetna acquisition significantly increased CVS Health’s debt burden.

* Integration Challenges: Integrating Aetna into the CVS Health ecosystem has proven to be complex and time-consuming.

* Regulatory Scrutiny: The PBM industry faces increasing scrutiny from regulators and policymakers.

* Competition: CVS Health faces intense competition from other pharmacy chains, health insurers, and online retailers.

Ideal User Profile:

CVS Health is best suited for investors seeking a diversified healthcare company with a strong market position and a history of paying dividends. It may also appeal to investors who believe in the company’s integrated healthcare model and its potential to improve patient outcomes and reduce costs.

Key Alternatives (Briefly):

* Walgreens Boots Alliance (WBA): A major competitor in the retail pharmacy market.

* UnitedHealth Group (UNH): A leading health insurer with a growing presence in the pharmacy services market.

Expert Overall Verdict & Recommendation:

CVS Health presents a compelling investment opportunity, but it’s not without risks. The company’s diversified business model, integrated healthcare strategy, and strong market position offer significant advantages. However, the debt burden, integration challenges, and regulatory scrutiny warrant careful consideration. Overall, CVS Stock is a solid choice for investors with a long-term perspective and a tolerance for moderate risk. We recommend a buy-and-hold strategy, focusing on the company’s long-term growth potential.

Final Thoughts on CVS Stock

CVS Stock represents an investment in a company undergoing a significant transformation. From its roots as a pharmacy chain, CVS Health has evolved into a diversified healthcare provider with a vision to deliver integrated, consumer-centric care. While challenges remain, the company’s strategic initiatives and strong market position suggest a promising future. As CVS Health continues to execute its strategy, it is well-positioned to create value for shareholders and improve the lives of patients. Consider CVS stock as a long-term investment, and consider consulting a financial advisor before making any decisions.