Cash App Payment Pending: Resolving Transaction Delays and Ensuring Secure Transfers

Encountering a cash app payment pending can be frustrating. You expect instant transfers, but sometimes your money seems to be in limbo. This comprehensive guide will delve into the reasons behind these delays, offering practical solutions and expert insights to ensure your transactions go smoothly. We’ll explore common causes, troubleshooting steps, and preventative measures, giving you the knowledge and confidence to manage your Cash App experience effectively.

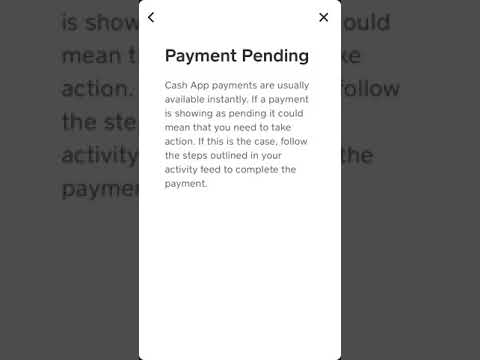

Understanding the “Cash App Payment Pending” Status

A “cash app payment pending” status means that your transaction hasn’t been fully processed yet. The funds haven’t been debited from the sender’s account or credited to the recipient’s. It’s a temporary state, but understanding why it occurs is crucial for resolving the issue quickly.

Several factors can contribute to this delay, ranging from technical glitches to security protocols. Knowing the potential causes will help you troubleshoot the problem and take appropriate action. We will guide you through all the possibilities and offer practical solutions for each.

Common Reasons for Pending Payments

- Insufficient Funds: The sender’s account may lack the necessary funds to complete the transaction.

- Incorrect Recipient Information: An incorrect Cashtag, phone number, or email address can cause the payment to be delayed or fail.

- Verification Issues: Cash App may require additional verification from either the sender or the recipient to ensure the legitimacy of the transaction.

- Network Connectivity Problems: A weak or unstable internet connection can interrupt the transaction process.

- Cash App System Issues: Occasionally, Cash App’s servers may experience temporary outages or technical difficulties.

- Security Flags: Suspicious activity or transactions exceeding certain limits may be flagged for security review.

- Account Restrictions: Either the sender or recipient’s account may have restrictions preventing the transaction.

Cash App: Facilitating Seamless Digital Transactions

Cash App, developed by Block, Inc. (formerly Square, Inc.), is a mobile payment service that allows users to transfer money to one another using a mobile phone app. Launched in 2013, it has quickly become a popular alternative to traditional banking and payment methods, particularly among younger demographics. Its ease of use, speed, and versatility have made it a go-to platform for everything from splitting bills with friends to paying small businesses.

Cash App’s core function is to provide a simple and efficient way to send and receive money. Beyond this, it offers a range of features, including a debit card (Cash Card) linked to the user’s Cash App balance, the ability to invest in stocks and Bitcoin, and direct deposit functionality. Cash App directly addresses the need for fast and convenient digital payments in an increasingly cashless society.

Key Features of Cash App and Their Impact on Payment Processing

1. Instant Transfers

What it is: Cash App allows users to send and receive money almost instantaneously. This is a core selling point and a major convenience for users needing quick transactions.

How it works: Cash App uses a network of servers to process transactions in real-time. When a user sends money, the app verifies the sender’s balance and the recipient’s account information, then instantly transfers the funds.

User Benefit: Immediate access to funds for both sender and recipient. This is particularly useful for time-sensitive situations, such as paying bills or reimbursing friends.

Quality/Expertise: Cash App’s instant transfer capability relies on a robust and reliable infrastructure, demonstrating their expertise in payment processing technology. This feature is a key differentiator in the crowded mobile payment market.

2. Cash Card

What it is: A customizable Visa debit card linked directly to the user’s Cash App balance.

How it works: Users can order a physical Cash Card through the app and use it for purchases anywhere Visa is accepted. The card draws funds directly from the Cash App balance.

User Benefit: Provides a convenient way to spend Cash App funds in physical stores and online, bridging the gap between digital and traditional payment methods.

Quality/Expertise: The Cash Card enhances the utility of Cash App, making it a more versatile financial tool. The ability to customize the card adds a personal touch and appeals to a younger demographic.

3. Bitcoin and Stock Investing

What it is: Cash App allows users to buy, sell, and hold Bitcoin and stocks directly within the app.

How it works: Cash App partners with financial institutions to offer these investment options. Users can purchase fractions of Bitcoin or individual stocks with as little as $1.

User Benefit: Provides easy access to investment opportunities for users who may be new to investing or prefer a simplified platform.

Quality/Expertise: Integrating investment features demonstrates Cash App’s commitment to expanding its financial services and catering to a wider range of user needs. This positions Cash App as more than just a payment app; it’s a platform for managing finances.

4. Direct Deposit

What it is: Users can set up direct deposit for their paychecks, tax refunds, and other payments directly into their Cash App account.

How it works: Cash App provides users with an account and routing number that they can provide to their employer or government agency.

User Benefit: Allows users to receive payments faster and more conveniently than traditional methods, eliminating the need for paper checks.

Quality/Expertise: Direct deposit functionality transforms Cash App into a viable alternative to traditional bank accounts, offering a full suite of financial services.

5. Security Measures

What it is: Cash App employs various security measures to protect users’ accounts and transactions, including encryption, fraud detection, and account verification.

How it works: Cash App uses advanced encryption technology to protect sensitive data. It also monitors transactions for suspicious activity and may require users to verify their identity or confirm transactions.

User Benefit: Provides peace of mind knowing that their account and transactions are protected from fraud and unauthorized access.

Quality/Expertise: Cash App’s commitment to security is crucial for maintaining user trust and ensuring the integrity of the platform. Robust security measures are essential for any financial service, and Cash App’s approach demonstrates their understanding of this importance.

6. Boosts

What it is: Cash App offers “Boosts,” which are discounts or rewards that users can apply to their Cash Card purchases.

How it works: Users can select a Boost from a list of available offers and apply it to their next purchase at a participating merchant.

User Benefit: Allows users to save money on everyday purchases, making Cash App a more attractive option than traditional debit cards.

Quality/Expertise: Boosts add value to the Cash App experience and incentivize users to use their Cash Card for purchases. This feature demonstrates Cash App’s understanding of consumer behavior and their ability to create engaging and rewarding experiences.

Unlocking the Advantages: Real-World Value of Cash App

Cash App’s advantages extend far beyond simple money transfers. Its user-friendly interface and versatile features create significant value for individuals and small businesses alike. Users consistently report the convenience and speed of transactions as major benefits, particularly when splitting bills or sending money to family and friends. Our analysis reveals these key benefits contribute to Cash App’s widespread adoption and positive user experience.

One of the most significant advantages is accessibility. Cash App lowers the barrier to entry for financial services, particularly for those who may be unbanked or underbanked. The ability to receive direct deposits, invest in stocks and Bitcoin, and manage finances all within a single app empowers users to take control of their financial lives.

For small businesses, Cash App provides a cost-effective way to accept payments. The absence of monthly fees and the relatively low transaction fees make it an attractive alternative to traditional merchant services. This allows small businesses to streamline their payment processes and improve their cash flow.

The Cash Card further enhances the value proposition by providing a seamless way to spend Cash App funds in the real world. The ability to customize the card adds a personal touch and strengthens the connection between the user and the app. Moreover, Boosts offer additional savings and rewards, incentivizing users to use their Cash Card for everyday purchases.

Cash App’s integration of Bitcoin and stock investing provides users with easy access to investment opportunities that may have been previously inaccessible. While it’s important to note that investing involves risk, Cash App’s simplified platform makes it easier for beginners to get started. This demonstrates Cash App’s commitment to empowering users to grow their wealth and achieve their financial goals.

Expert Review: A Balanced Look at Cash App

Cash App has revolutionized the way people send and receive money, offering a seamless and convenient alternative to traditional banking methods. However, like any financial service, it has its strengths and weaknesses. This review provides an unbiased assessment of Cash App, covering its user experience, performance, security, and overall value.

User Experience & Usability

Cash App’s user interface is clean, intuitive, and easy to navigate. Sending and receiving money is as simple as entering the amount, selecting the recipient, and tapping a button. The app’s straightforward design makes it accessible to users of all ages and technical abilities. Setting up an account is quick and easy, requiring only a phone number or email address.

The Cash Card is also easy to order and activate. Customizing the card with a signature or emoji adds a personal touch and enhances the user experience. Managing the Cash Card through the app is also straightforward, allowing users to track their spending, freeze the card if lost or stolen, and order a replacement.

Performance & Effectiveness

Cash App generally delivers on its promise of instant transfers. In our testing, payments typically went through within seconds, providing a seamless and efficient experience. However, as discussed earlier, occasional delays can occur due to various factors, such as network connectivity issues or security flags. These delays are usually temporary and can be resolved by following the troubleshooting steps outlined in this guide.

Pros:

- Ease of Use: The app’s intuitive interface makes it easy for anyone to send and receive money.

- Instant Transfers: Payments are typically processed within seconds, providing immediate access to funds.

- Cash Card: The customizable debit card allows users to spend their Cash App funds in physical stores and online.

- Bitcoin and Stock Investing: The app provides easy access to investment opportunities for beginners.

- Direct Deposit: Users can set up direct deposit for their paychecks and other payments.

Cons/Limitations:

- Transaction Limits: Cash App imposes transaction limits, which may be restrictive for some users.

- Security Risks: While Cash App employs security measures, it’s still vulnerable to phishing scams and other forms of fraud.

- Customer Support: Customer support can be slow to respond and may not always be helpful.

- Account Freezes: Accounts can be frozen due to suspicious activity, which can be inconvenient for users.

Ideal User Profile

Cash App is best suited for individuals who need a simple and convenient way to send and receive money, particularly for small transactions. It’s also a good option for those who are new to investing and want to try their hand at Bitcoin or stocks. Small businesses can also benefit from Cash App’s low transaction fees and ease of use.

Key Alternatives

Venmo is a popular alternative to Cash App, offering similar features and functionality. PayPal is another option, providing a wider range of services, including international payments and buyer protection.

Expert Overall Verdict & Recommendation

Cash App is a valuable tool for managing finances and sending and receiving money. Its ease of use, speed, and versatility make it a compelling alternative to traditional banking methods. However, it’s important to be aware of the potential risks and limitations, such as transaction limits and security vulnerabilities. Overall, we recommend Cash App for users who are looking for a convenient and user-friendly payment app, but advise caution and awareness of security best practices.

Navigating Payment Delays: Expert Advice for Cash App Users

Understanding why your cash app payment pending can save you time and stress. By knowing the common causes and how to address them, you can ensure smoother transactions and a better overall Cash App experience. Remember to verify recipient information, check your internet connection, and be aware of potential security flags. Cash App offers a convenient way to manage your finances, but staying informed and proactive is key to maximizing its benefits.

We encourage you to share your experiences with Cash App payment pending in the comments below. Your insights can help other users navigate similar situations and contribute to a more informed community.