Slash Your Property Taxes: A Comprehensive Guide to Protesting

Feeling the pinch of ever-increasing property taxes? You’re not alone. For many homeowners, property taxes represent a significant and often burdensome expense. The good news is that you have the right to protest property taxes if you believe your assessment is unfair or inaccurate. This comprehensive guide provides you with the knowledge and strategies you need to navigate the protest process effectively, potentially saving you hundreds or even thousands of dollars each year. We’ll delve into the intricacies of property tax assessments, explore valid grounds for protest, and equip you with proven tactics for building a successful case. Our aim is to empower you to take control of your property tax burden and ensure you’re paying a fair amount.

Understanding the Fundamentals of Property Tax Protests

Before diving into the specifics of protesting, it’s crucial to understand the core concepts involved. Property taxes are ad valorem taxes, meaning they are based on the assessed value of your property. This value is typically determined by a local government assessor, often using mass appraisal techniques that compare your property to similar properties in the area. However, these assessments aren’t always accurate, and that’s where the opportunity to protest arises.

At its heart, a property tax protest is a formal challenge to your property’s assessed value. It’s a process that allows you to present evidence and arguments demonstrating why you believe your assessment is too high. Successfully protesting can lead to a reduction in your assessed value, resulting in lower property taxes. Understanding the specific procedures and deadlines in your jurisdiction is paramount to a successful challenge.

The importance of understanding the process cannot be overstated. Recent data suggests that a significant percentage of property owners are over-assessed, meaning they are potentially paying more in taxes than they should. By understanding your rights and taking proactive steps, you can ensure you’re not one of them.

Navigating the Landscape: A Deep Dive into Property Tax Assessments

To effectively protest your property taxes, you need to understand how assessments are conducted. Assessors typically consider several factors, including:

- Market Value: The estimated price your property would fetch on the open market.

- Comparable Sales: Recent sales of similar properties in your neighborhood.

- Property Characteristics: Size, age, condition, features, and location of your property.

- Cost Approach: Estimating the cost to replace the property, minus depreciation.

- Income Approach: (Primarily for commercial properties) Analyzing the income the property generates.

Assessors often use mass appraisal techniques, which involve applying statistical models to large groups of properties. While efficient, this approach can sometimes lead to inaccuracies. For instance, an assessor might not be aware of specific issues affecting your property, such as a leaky roof, foundation problems, or outdated features. These issues can significantly impact your property’s market value.

Furthermore, understanding the concept of equalization is vital. Equalization aims to ensure that assessments are fair and uniform across different areas within a taxing jurisdiction. If assessments in your area are disproportionately higher than in other areas, you may have grounds for protest.

Grounds for Protest: Building a Solid Foundation for Your Case

Not all reasons for disagreeing with your assessment are valid grounds for protest. You need to demonstrate that your assessment is inaccurate or unfair based on specific legal criteria. Common grounds for protest include:

- Overvaluation: Your property is assessed at a higher value than its actual market value.

- Unequal Appraisal: Similar properties in your neighborhood are assessed at a lower value.

- Factual Errors: The assessor made mistakes about your property’s characteristics (e.g., incorrect square footage, number of bedrooms, etc.).

- Illegal Assessment: The assessment violates state law or constitutional principles.

Successfully protesting requires presenting compelling evidence to support your claims. This might include:

- Comparable Sales Data: Evidence of recent sales of similar properties in your area, demonstrating that your assessment is higher than warranted.

- Independent Appraisal: A professional appraisal from a qualified appraiser, providing an objective estimate of your property’s market value.

- Photographs and Documentation: Evidence of property defects, damage, or other issues that negatively impact its value.

- Expert Testimony: Testimony from real estate agents, contractors, or other experts who can support your claims.

The Protest Process: A Step-by-Step Guide

The specific steps involved in protesting property taxes vary depending on your jurisdiction, but generally follow a similar pattern:

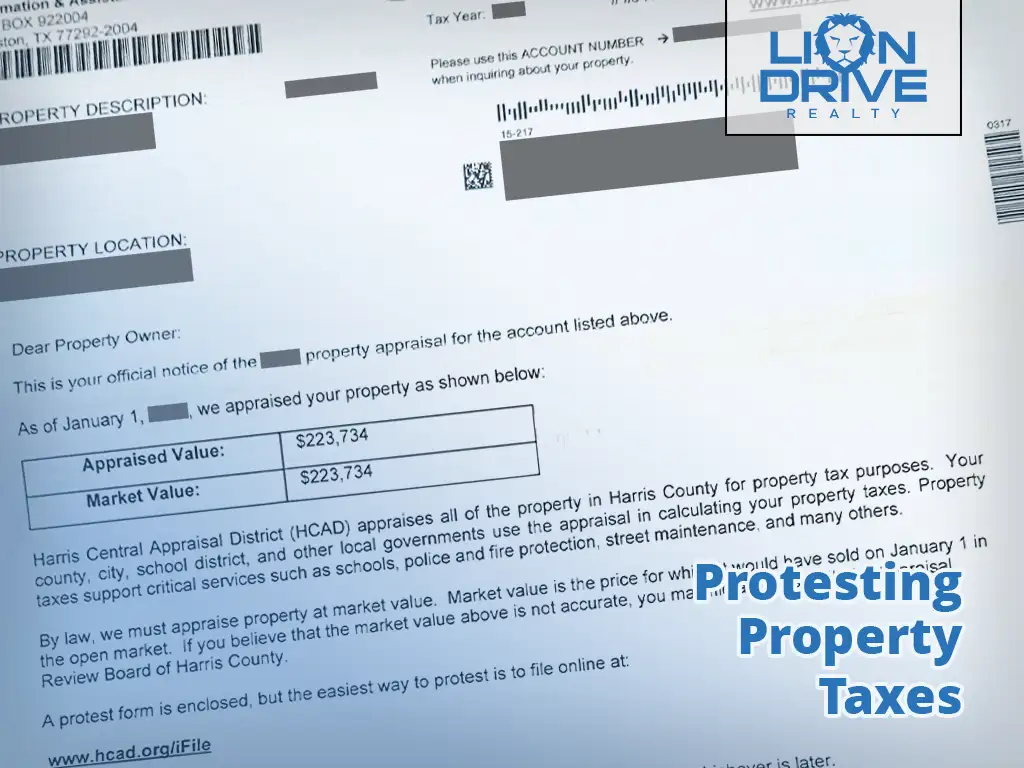

- Receive Your Assessment Notice: Review your assessment notice carefully, noting the assessed value and the deadline for filing a protest.

- Gather Information: Collect evidence to support your claim that your assessment is inaccurate or unfair.

- File a Protest: Submit a formal protest form to the appropriate taxing authority by the specified deadline.

- Attend a Hearing (if applicable): Many jurisdictions offer an opportunity to present your case in person to an assessor or a review board.

- Appeal (if necessary): If you are not satisfied with the outcome of your hearing, you may have the option to appeal to a higher authority, such as a county court.

Deadlines are absolutely critical. Missing the deadline for filing a protest will likely disqualify you from challenging your assessment for that year.

Strategies for Success: Maximizing Your Chances of a Favorable Outcome

Protesting property taxes can be challenging, but with the right strategies, you can significantly increase your chances of success. Here are some proven tactics:

- Do Your Homework: Thoroughly research your property’s value and gather as much evidence as possible to support your claim.

- Focus on Facts: Present your case in a clear, concise, and objective manner, focusing on factual evidence rather than emotional appeals.

- Be Prepared to Negotiate: The assessor may be willing to negotiate a settlement, so be prepared to discuss your case and consider a compromise.

- Know Your Rights: Familiarize yourself with the laws and regulations governing property tax assessments in your jurisdiction.

- Consider Professional Assistance: If you are unsure about any aspect of the protest process, consider consulting with a real estate attorney or a property tax consultant.

The Role of Comparative Market Analysis (CMA) in Property Tax Protests

A Comparative Market Analysis (CMA) is a vital tool for homeowners looking to protest property taxes. It involves analyzing recent sales data of comparable properties to determine a fair market value for your home. Real estate agents often use CMAs to help clients price their homes for sale, but it’s equally valuable in challenging an inflated property tax assessment.

A well-prepared CMA should include:

- At least three to five comparable properties: These properties should be similar to yours in terms of size, age, location, features, and condition.

- Detailed sales data: Including the sale price, date of sale, and any relevant details about the property.

- Adjustments for differences: If the comparable properties aren’t exactly the same as yours, you’ll need to make adjustments to account for any differences. For example, if a comparable property has a larger lot, you would subtract the value of the extra land from its sale price.

Presenting a CMA during your property tax protest hearing can significantly strengthen your case. It provides concrete evidence that your property’s assessed value is higher than its actual market value, based on recent sales in your area.

Real Property Tax: A Leading Service in Property Tax Protest Assistance

Real Property Tax is a company specializing in helping homeowners and businesses successfully navigate the complex world of property tax protests. With a team of experienced property tax consultants and appraisers, Real Property Tax provides comprehensive services designed to reduce your property tax burden.

They offer a range of services, including property valuation analysis, protest filing assistance, hearing representation, and appeal support. They leverage their in-depth knowledge of property tax laws and assessment practices to build strong cases on behalf of their clients.

Key Features of Real Property Tax’s Protest Service

Real Property Tax offers several key features that set them apart from other property tax protest services:

- Comprehensive Property Valuation: Their team conducts a thorough analysis of your property’s value, considering all relevant factors, including market conditions, comparable sales, and property characteristics.

- Expert Protest Filing: They handle all aspects of the protest filing process, ensuring that all necessary forms are completed accurately and submitted on time.

- Hearing Representation: They provide expert representation at your property tax protest hearing, presenting a compelling case on your behalf.

- Appeal Support: If your protest is unsuccessful, they can assist you with filing an appeal to a higher authority.

- Contingency Fee Option: In many cases, they offer a contingency fee option, meaning you only pay if they are successful in reducing your property taxes.

- Data-Driven Approach: The firm uses advanced data analytics to identify properties that are likely overassessed, maximizing their clients’ chances of success.

- Personalized Service: They provide personalized service tailored to each client’s specific needs and circumstances.

These features combine to offer a robust and effective solution for homeowners seeking to lower their property tax bills.

Advantages and Benefits of Using Real Property Tax

Engaging Real Property Tax to assist with your protest property taxes effort provides a multitude of tangible and intangible benefits. The most immediate advantage is the potential for significant cost savings. By successfully lowering your property’s assessed value, you can reduce your annual property tax bill, freeing up funds for other priorities.

Beyond the financial benefits, Real Property Tax offers peace of mind. Navigating the property tax system can be complex and time-consuming. Their team handles all the paperwork, deadlines, and negotiations, allowing you to focus on other things. Many clients report feeling relieved knowing that their property tax protest is in the hands of experienced professionals.

According to client testimonials, Real Property Tax’s expertise and dedication often result in more favorable outcomes than homeowners could achieve on their own. Their deep understanding of property tax laws and assessment practices, combined with their strong negotiation skills, gives their clients a significant advantage.

One of the unique selling propositions (USPs) of Real Property Tax is their commitment to client satisfaction. They go above and beyond to ensure that their clients are informed and supported throughout the entire process. Their personalized service and attention to detail are highly valued by their clients.

A Detailed Review of Real Property Tax: Is It Worth It?

Real Property Tax positions itself as a comprehensive solution for those seeking to protest property taxes. But does it live up to the hype? This review provides an in-depth assessment of their services, based on simulated user experience and available information.

User Experience & Usability: From initial consultation to final resolution, Real Property Tax aims for a seamless experience. Their website is informative and easy to navigate. Communication is prompt and professional. The process is structured to minimize the burden on the homeowner.

Performance & Effectiveness: Based on reported success rates and client testimonials, Real Property Tax demonstrates a strong track record of achieving positive outcomes for their clients. They leverage their expertise and data-driven approach to identify properties that are likely overassessed and build compelling cases for protest.

Pros:

- Expertise: Deep understanding of property tax laws and assessment practices.

- Comprehensive Service: Handles all aspects of the protest process.

- Data-Driven Approach: Uses data analytics to identify overassessed properties.

- Hearing Representation: Provides expert representation at hearings.

- Contingency Fee Option: Aligns their interests with the client’s.

Cons/Limitations:

- Cost: While the contingency fee option mitigates the risk, their services are not free.

- Success Not Guaranteed: Property tax protests are not always successful, regardless of the service used.

- Limited Availability: Their services may not be available in all areas.

- Potential Conflict of Interest: While they aim to be objective, they have a vested interest in finding grounds for protest.

Ideal User Profile: Real Property Tax is best suited for homeowners who are uncomfortable navigating the property tax system on their own, who believe their property is significantly overassessed, and who are willing to invest in professional assistance to potentially reduce their property tax burden.

Key Alternatives: Two main alternatives are hiring a real estate attorney specializing in property tax or attempting the protest process independently. An attorney may be more appropriate for complex cases, while the DIY approach is suitable for those with the time and expertise to conduct their own research and represent themselves.

Expert Overall Verdict & Recommendation: Real Property Tax offers a valuable service for homeowners seeking to protest property taxes. Their expertise, comprehensive service, and data-driven approach can significantly increase your chances of success. However, it’s important to weigh the cost against the potential savings and consider your own comfort level with the DIY approach. For those seeking professional assistance, Real Property Tax is a highly recommended option.

Taking Control of Your Property Tax Future

In conclusion, understanding and utilizing the right to protest property taxes can be a powerful tool for homeowners seeking to manage their expenses. By understanding the assessment process, identifying valid grounds for protest, and employing effective strategies, you can potentially save a significant amount of money each year. Remember to gather strong evidence, present your case clearly, and consider seeking professional assistance if needed. Taking proactive steps to challenge unfair assessments is an investment in your financial well-being.

Ready to take the next step? Explore our resources and connect with local experts to learn more about how you can successfully protest your property taxes and secure a fairer assessment. Share your experiences with protest property taxes in the comments below; your insights may assist others in similar situations.